Bitcoin remains the standard for cryptocurrencies but it is common knowledge that it is far from perfect. It was not meant to be the ultimate solution, anyway: from the beginning, developers were free to introduce their designs and visions to compete with BTC. And develop they did! The ChangeHero team reviews some of the most painful issues of Bitcoin and highlights altcoins that made significant progress in solving them.

Problems with Bitcoin

Volatility

As Satoshi Nakamoto envisioned it, the price of Bitcoin would be determined by its circulating supply and the miners who secure the network and for the time being, mint new bitcoins. As years went by, speculation also entered the stage and now influences the price of Bitcoin, too. Of course, cypherpunks, who generally believed in the free markets, wouldn’t want to have it any other way. At the same time, it directly or indirectly leads to the rest of the issues on our list.

Poor Scalability

In 2009, probably not even Satoshi expected BTC to get this big without introducing major scalability updates. We shouldn’t forget SegWit and Taproot upgrades that considerably improved the situation but still, BTC’s transaction per second throughput remains in single digits. Bitcoin’s native solution to scalability woes, Lightning Network, has a host of challenges of its own and barely sees any use.

From a technical perspective, a decentralized network like Bitcoin may be a miracle but from a user standpoint, waiting for up to an hour to just send a simple transaction is by no means a good user experience.

Skyrocketing Network Fees

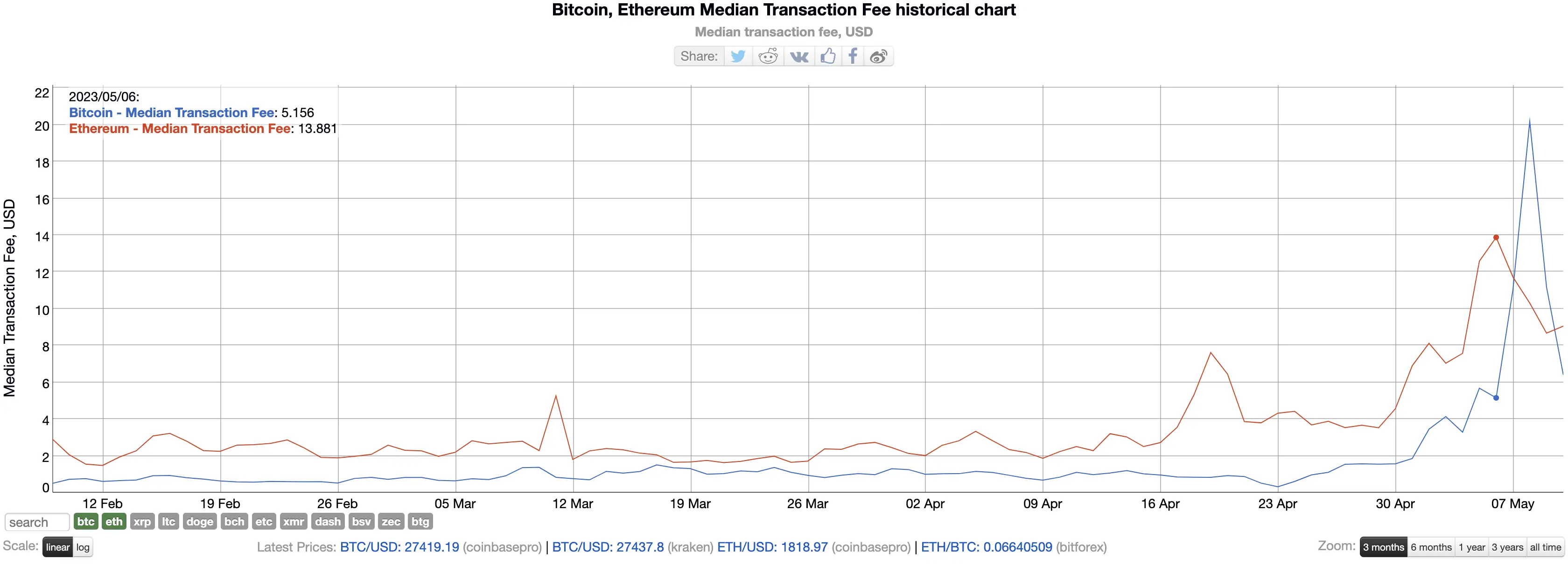

Volatile prices and low throughput contribute to one of the most glaring problems with Bitcoin. Every once in a while, BTC would make news with record-breaking network fees.

In large part, it is a direct consequence of Bitcoin’s original design. It was developed to have a fee auction system: every transaction incurs a fee that goes toward miners. There is a limited amount of space in each block, so a limited amount of transactions can be included in the blockchain every 10 minutes. Those who pay higher network fees get priority. In addition, if one’s transaction is stuck, they can resubmit it with a higher fee.

Thus, users who can afford it push up the fees for everyone else. The race to get one’s transaction through gets especially heated if there is strong volatility in BTC. Even if the fees recounted in BTC remain more or less stable, if its price in USD grows, the fee recounted in fiat grows, too.

Environmental Impact and Energy Consumption

There is another reason Bitcoin in its original design was not meant to scale to a global audience. The process of mining is based on proof-of-work, used to be employed in email spam protection, and required very little computing power. However, as more miners join the network, more hash power becomes necessary to mine competitively. It was not long before mining became a business on an industrial scale that consumes huge amounts of electricity.

Bitcoin proponents these days argue that Bitcoin takes care of electricity surplus, and uses renewable and green energy sources. However, the electricity grids are generally balanced, and the use of renewable energy sources can just as well be put towards other needs. Besides, it sometimes gets ignored that miners tend to move to places with cheap and reliable electricity, with little to no concern about the kind of fuel that powers the local grid or its resistance to the exorbitant load.

Altcoins That Solve BTC’s Issues

Ethereum

The second-largest cryptocurrency is popular enough for reasons unrelated to Bitcoin. But now it is an example of how BTC can become less controversial to the mainstream.

After it has completed the transition from Proof-of-Work to Proof-of-Stake, Ethereum’s carbon emissions and energy consumption have been reduced considerably. There are now campaigns to push Bitcoin users to follow suit and move past the energy-hungry PoW.

Unsurprisingly, this is a controversial topic, and, to Bitcoin maximalists, is definitely out of the question. They remind the opponents that Proof-of-Stake is not a perfect consensus algorithm either, and it has issues with centralization. Ethereum was in a more fortunate position to initiate the protocol change because it was coded into the protocol from the very beginning. Sure, there were miners who were not happy with the change and remained on the fork of the blockchain that kept PoW. However, they remained in the minority but there is no guarantee that the same will happen in Bitcoin.

As for the transaction fees and scalability, Ethereum has not moved far ahead of BTC yet. The chart above shows that on a regular day, the median fee in ETH is even higher than in BTC. But this is precisely why we will highlight other alternatives to Bitcoin that solve this!

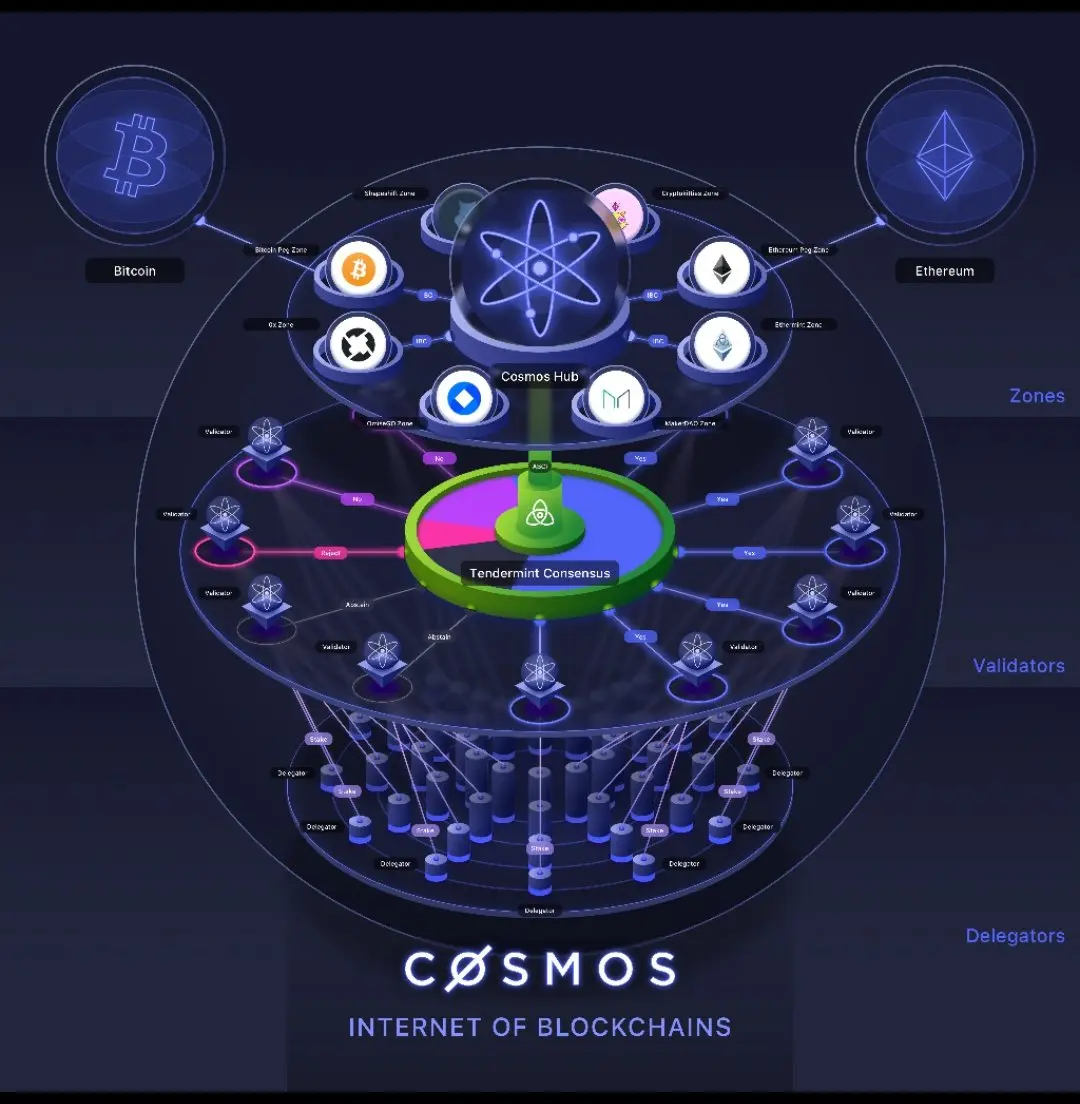

Cosmos

The second altcoin that our team will compare to BTC is Cosmos (ATOM). It is also a Proof-of-Stake coin, which means it is more environmentally friendly than Bitcoin as well. However, Cosmos solves another problem with Bitcoin: it is a network built to scale.

Let’s take a look at the current state of Bitcoin: it has scored a record number of daily transactions, reaching an all-time high on May, 1. It was all thanks to Bitcoin Ordinal Inscriptions, a protocol to issue non-fungible token-like assets on the Bitcoin blockchain. They generated quite a lot of conversation and network congestion but the on-chain data suggests it does not correspond to meaningful network growth. Nevertheless, the effect of the BRC-20 tokens was felt by all Bitcoin users.

Cosmos, on the other hand, is a network of interoperable blockchains, and each application can have a sidechain of its own. These apps and side chains can effortlessly run at the same time, without causing any issues for the rest of the network.

Toncoin

Another altcoin that makes the issues of Bitcoin a thing of the past is Toncoin (TON). Can it be used for payments that don’t take hours if you undercharge? Sure! Does it cost a lot to send TON? Not at all! Is it secured by an unwieldy outdated consensus algorithm? You guessed it right: no.

Regardless of all of the above, Toncoin was a step ahead of simply fixing Bitcoin. It is taking the shape of an infrastructure to help build Web3: the next generation of the Internet. Web3 is supposed to be more fair and decentralized than the Internet of today which is excessively concentrating around large platforms and infrastructure providers. To this end, The Open Network is launching services like TON Sites and TON Proxy.

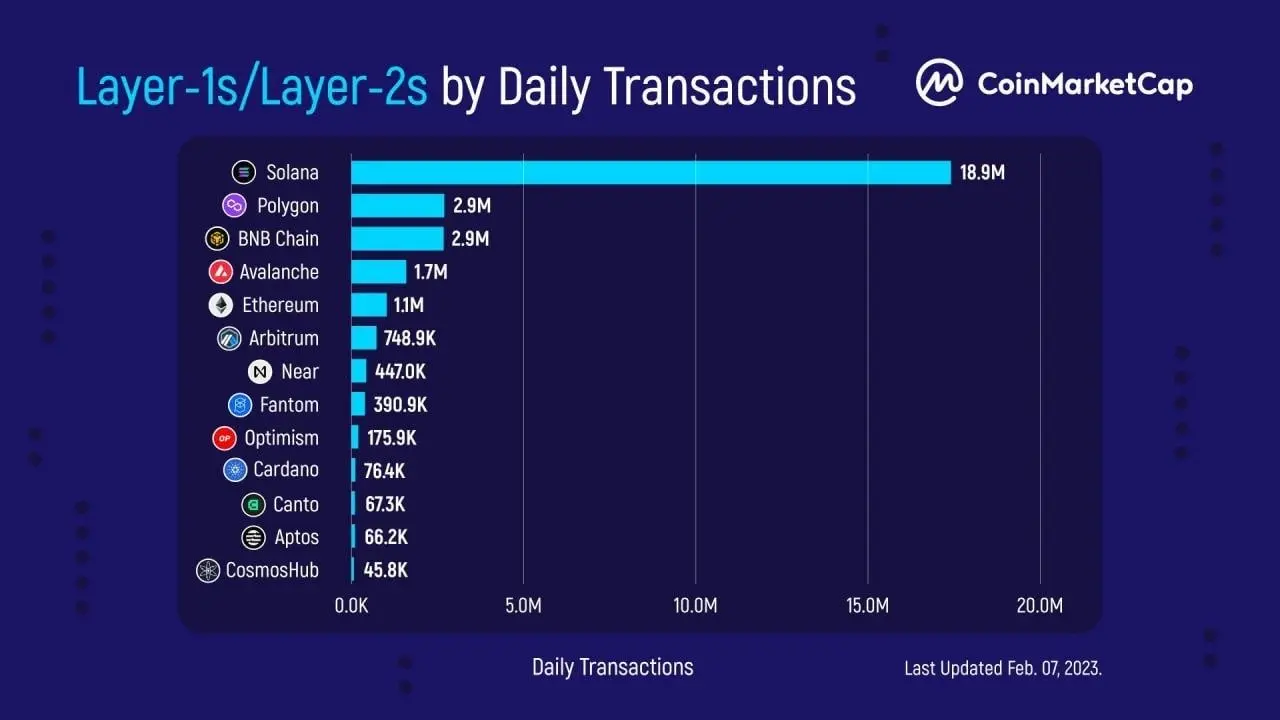

Solana

No matter how you look at it, Solana (SOL) achieves impressive results in the departments of scalability, low fees, and energy efficiency. It even outdoes Ethereum on all these fronts.

Unlike TON or Cosmos, Solana works at the speed of thousands of transactions per second thanks to its consensus protocol. It makes it usable for more than simple value transfers but even these occur for a fraction of the costs in comparison to BTC.

Sui

All of the coins we have reviewed so far still experience volatility. Moreover, they are gas tokens of their respective blockchains. If it affects network fees in times of heightened volatility and makes it unfeasible to transact often, why not change how fees work?

This is what the Sui developers attempted to do. Instead of the fee auction, they included complex formulas in the protocol to make fees more predictable. The formulas they use are fairly complicated but summarized in simple words, their approach is to make gas a commodity for all to be able to afford, rather than a luxury for a few.

Sui is still a new blockchain, so it remains to be seen if it succeeds in its attempt to solve the fee problem that permeates so many cryptocurrency protocols.

Stablecoins

Last but not least, stablecoins, which are a whole different kind of cryptocurrency from Bitcoin. They were always meant to complement both BTC and fiat currencies. However, they do solve a couple of issues with it.

For one, it’s in the name — stablecoins have a predictable value. Of course, they are pegged to the value of a fiat currency, and these tend to be volatile relative to each other, too. However, just like in physics and mathematics, the reference frame dictates whether something appears still and stable or moving. As it is now, fiat currencies like the US dollar are a baseline for the prices of crypto, so stablecoins pegged to USD remain stable in value.

Since these tokens are tied to a fiat currency that is widely recognized as money, it also solves the recognizability issue of BTC. It is much easier to determine the price of a good or service in tethers than in bitcoins at any given time.

Conclusion

Even after all those years and with thousands of altcoins around, Bitcoin remains on top despite its shortcomings. This does not mean that they should not be fixed, and the coins we reviewed show how crypto can be even better.

We have even more content about news, trends, and projects of the crypto world in our blog. Our team also provides original and topical content on Twitter, subreddit, Facebook, and Telegram — check them out and sign up, too!