As the US presidential election draws nearer, more and more people are getting agitated about the possible winner. This is why prediction markets are especially hot right now, as crypto enthusiasts flock to platforms that can yield them some profit from their educated guesses. In this Augur guide, ChangeHero team will explain the protocol and its native token, REP, review the recent network upgrade and tell you how to buy Augur tokens and why.

What is Augur?

Prediction markets are a popular form of betting. In the real world, there are quite a lot of businesses made on the same premise, in which an entity controls the bets and finalizes the payouts based on the outcomes of events people bet on. These businesses make profit on the fees collected from the winners’ payouts, and operate on trust of the clients. The idea behind the Augur protocol is to put prediction markets on to a decentralized platform, eliminating these drawbacks.

Augur is a protocol that allows users to create prediction markets. In these prediction markets, a creator poses a question about an event in the future, and other users can bet on any of the possible outcomes of such an event.

The Augur protocol has a very interesting history, so before diving into the mechanics, let’s see how it developed over years in the next section of our Augur guide!

How did Augur start?

Augur is a fairly old player on the market. Among the people that made the protocol in its current form are Joey Krug, Jeremy Gardner and Jack Peterson. Initially, their project was supposed to become an implementation of the Truthcoin (implementation of prediction markets on the fork of Bitcoin blockchain) protocol. However, in the final stages of Ethereum development, Vitalik Buterin found out about the project and approached Krug with the proposal to build on that platform.

To make a rehauled version of the protocol happen, The Forecast Foundation was formed and an ICO was held in fall of 2015. In fact, it was the very first ICO held on Ethereum. During it, 80% of the initial release of 11 thousand native Augur crypto, REP tokens were distributed, and it raised $5 million at that time. After that, a long period of development started, and the platform launched only in July, 2018.

Krug himself and the team called the Augur v1 slow and difficult to use, but it has shown that the idea of a decentralized prediction market platform is feasible. The development did not stop at that, and in summer of 2020, Augur v2, which came with a bunch of dApp integrations and a new version of native Augur crypto, REP v2, was released. Another noteworthy change in v2 was that the prediction markets on the protocol were now able to work with USD values with the help of the DAI stablecoin.

So how does it now work, exactly? We’re about to cover this in the next sections of this Augur guide.

How do Augur markets work?

Market Creation

With the help of Augur platform, anyone can create a prediction market. All you have to do is to pose a question, define its type and expiration date, pay a gas fee and you’re good to go. There are three general types of prediction markets:

- Binary, or “yes or no” outcomes: “Will a COVID-19 vaccine be developed by the end of 2020?”;

- Categorical, multiple choice questions: “Who will win in the elections?”;

- Scalar, which implies an answer within the upper and lower boundaries for an event: “How much Bitcoin will be worth on a certain day?”

The additional incentive to create a market is that the creators share all the trading fees on their market with reporters (more on them a bit later).

Trading = Betting

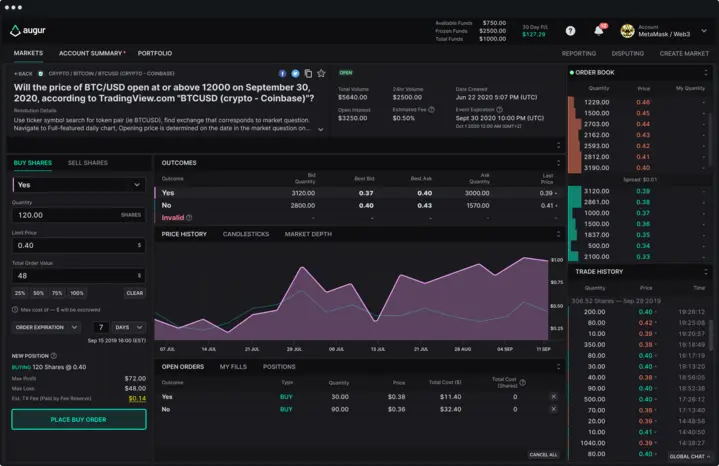

Other users can buy or sell shares that represent an outcome of an event. Buying is considered betting for and selling — against. As long as the market is active, these shares can be traded. Though called shares, these are just records in the smart contract.

Once the event occurs, the Augur oracles will report the outcome to the smart contract. Owners of the winning shares receive $1 for each share and losers do not receive anything.

If a question is worded poorly or subjective, users can bet that this market will be resolved as invalid. In that case, only the betters who have made this call will receive payout.

Outcome Verification

The event people bet on has occurred and the market has closed. It is time to pay out the rewards. How is it done?

When a market is opened, the creator is prompted to pick a reporter that will relay the outcome to the protocol within 24 hours from the event’s resolution. Upon resolution, this reporter submits the result as the tentative winning outcome. However, this outcome can be disputed, and this is when REP tokens come into play.

REP tokens are used for staking in the protocol to get more verification jobs, which in turn generate profit for the owner in the form of the trading fees on that market. The larger the stake, the higher the odds for being picked as a reporter and thus, more profit. Reporters are incentivized to give information accurate to the reality, because otherwise their outcome will get disputed. An oracle that wishes to dispute the tentative winning outcome has to stake twice as much as the initial reporter, but they get a chance of claiming all their profits off that market. The dispute also can go on until sixteen rounds, and in each round the stake has to double.

Though economically unfeasible and almost unlikely, should the dispute go on for more than sixteen rounds, the protocol will have to fork, and as far as Augur is concerned, there will be two versions in which there will be two true outcomes. However, as there can be only one outcome in the real world, the version of Augur in which a false outcome is considered true will fail economically as the users will have to choose a branch of the protocol, and the developers designed the protocol while being sure that they will pick the version which corresponds to the true events.

How does Augur compare to similar projects?

Gnosis

Another popular prediction market platform on Ethereum is Gnosis. Gnosis was launched in 2018, at the peak of ICO boom and Bitcoin rally, so while they did not have a head start Augur had, they also arrived at great starting conditions.

The differences between the two protocols are mainly technical. In Gnosis, outcome shares can be “detached” from the market and exist in the form of ERC-20 tokens, but as a result trading fees cannot be collected. Instead, the market creators and reporters receive a fixed fee market participants pay. In Augur, as stated above, the trading activity is recorded in the smart contract and is only relevant to that one market, which lets the trading fees accumulate and be collected.

Chainlink

The whitepaper for Augur states that the protocol will become the world’s first decentralized oracle. However, there is another name that comes to mind when we speak about decentralized oracles: Chainlink! To be fair, the two protocols excel in different areas: the Chainlink oracle network is geared towards data relaying, while Augur oracles do pretty much the same job but exist as a part of the protocol that powers prediction markets.

What is REP?

As it was already mentioned in this Augur guide, REP is a native token of the platform necessary to ensure honest work of oracles.

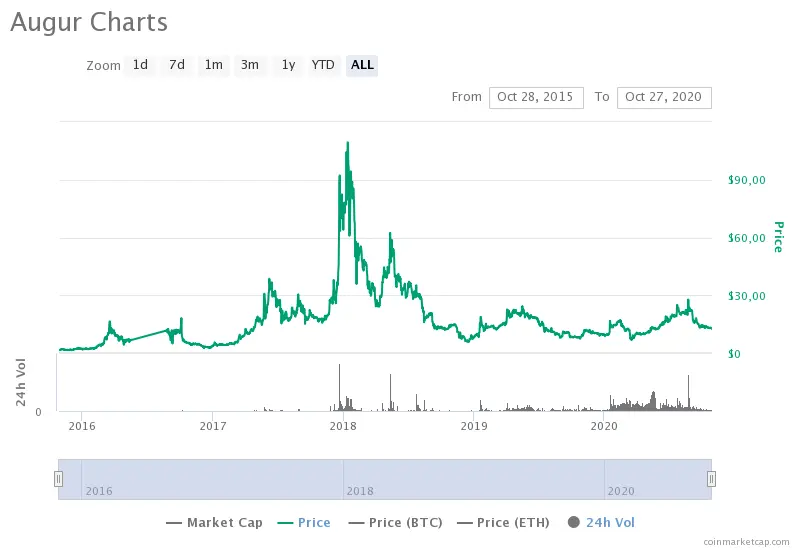

So the value of the REP token comes from the value of all the markets on the platform and how much profit they can bring to market makers and reporters. While this is a model that can work and swing the price of REP on its own, the token’s price is actually not a stranger to the movements of the whole market. For example, the current ATH for REP was seen at the peak of the late 2017–early 2018 Bitcoin rally ($99.80 on January 11, 2018). No new REP tokens have been minted since the ICO (which makes the supply 11 million), and with a market cap of $137,807,953 (rank 73) it makes a single token worth $12.53.

Use cases of REP

As already mentioned in our Augur guide, REP tokens are necessary for reporters. REP stands for “Reputation”. It plays a similar role to the LINK token in Chainlink: stake REP to get jobs, gain profit from doing this job, as in this case — accurately reporting the outcomes.

Unlike LINK, though, REP can also be staked against inaccurate reports. In that case, if the consensus is made about a new outcome, the disputer takes the trading fees. Augur developers believe this will encourage accurate reporting and help maintain the truthfulness of the outcomes.

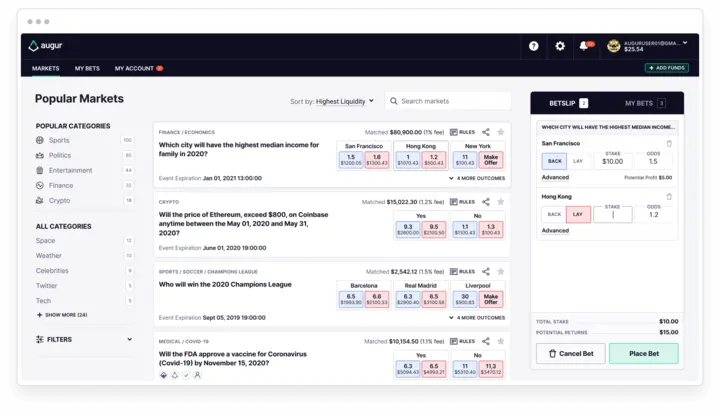

What are the markets currently open in Augur?

This comes as no surprise that right now, at the moment of writing this Augur guide, the most popular prediction markets have to do with the US politics, more specifically, the upcoming November 2020 presidential elections. There are not one or two but four open binary prediction markets in which people bet on the outcome: “Will Donald J. Trump win the 2020 US Presidential election?” The accumulated total volume of these markets comes up to $440 thousand dollars and the open interest accumulates up to $1.4 million. There is also a popular categorical market “Who will win the 2020 US Presidential election?” with more than $20 thousand open interest and volume.

There are plenty of other categories in Augur, too. At the time of writing our Augur guide, people bet on such things as:

- What will the total value locked (in billions USD) in DeFi be on December 31, 2020?

- Will the LA Lakers win the 2019–20 NBA Championship?

- Will the Effective Federal Funds Rate become negative, at any point between August 8, 2020 and December 31, 2020?

- Will there be 80 thousand or more total Covid-19 cases in Switzerland by midnight, December 31, 2020?

Is Augur controversial?

The Augur protocol has been surrounded with some controversial events.

- The creator of Truthcoin, the foundation of the Augur project, Paul Sztorc has made a strongly-worded case against Augur time and time again, despite initially advising the creators. According to him, the team has repurposed his protocol while introducing several unfeasible solutions and serious mistakes;

- Despite the claims that Augur operates on the premise of decentralization, the initial decision to launch an ICO and the subsequent long period of development has raised the community’s eyebrows and were regarded as suspicious;

- The fact that Augur platform is uncensorable was sooner or later bound to result in not exactly illegal but nevertheless ethically questionable assassination markets. The problem with betting on an individual’s date of death is that it gives a perpetrator either an incentive to “fulfill” the event or a chance to earn money from it.

- There is another reason why Forecast Foundation insists so fervently Augur is only a platform for prediction markets and the creators bear full responsibility for their own markets: the mechanism essentially allows market creators to create binary options, which is a tradeable product that has to be registered with the authorities before being offered to traders and investors.

Some of these controversies are a thing of the past and some are things the community is already working on: the markets in v2 are filtered by default, so if any dubious or straight up illegal market is created, with no censorship in place at least the creator will be made aware that their activity is not condoned by the majority of users. What matters more is the present and the future of the protocol. In the next couple of sections of this Augur guide, we will be looking at exactly that.

What is the future of Augur?

According to the blog post on the future of the protocol, in the next year a newer version of Augur is coming. It will have higher transaction throughput and low latency. With the platform in place and working as developers expected, their focus will be making new user interfaces, especially for mobile, for the time being. Augur Betting exchange interface and Augur sportsbook were already announced, albeit without a release date yet. The general vector of development for the Augur community now is user base growth.

Augur on Twitter

Over $1M+ in open interest and trading volume for @catnip_exchange 🔥 pic.twitter.com/tFdjMHSYbr

— Augur (@AugurProject) October 26, 2020

The official account of Augur platform simply could not stay silent when a product built on their protocol managed to attract millions of dollars. Unsurprisingly, the market that got the most people interested is, of course, the predictions about the US elections.

Just bought prediction market shares *directly on Twitter* via Uniswap and Augur using Maskbook wallet.

Unreal. pic.twitter.com/WGhpFTqQza — Ben Davidow (@Ben_davidow) October 19, 2020

One of the possible reasons these markets flew, as pointed out by Ben Davidow, is another product built on Augur. With the help of Augur, Foundry and Balancer protocols under the hood, Maskbook plugin allowed users to buy Augur shares while browsing Twitter. Looks pretty impressive!

Prediction mkts surge in US elections:

Intrade, 2012: $230M (shut down) Betfair, 2016: $250M (excludes USA) PredictIt, 2016: >$100M (limits bets) What is the $$$ potential for an unlimited, global prediction market like #Augur in this heated 2020 election?$REP @AugurProject — James Todaro, MD (@JamesTodaroMD) January 11, 2020

While some consider prediction markets a niche affair, James Todaro proves with numbers that this is still a large niche. In addition, he also cites the problems with centralized betting platforms: shutdowns, limits and regional restrictions. In this light, the potential of Augur is obvious.

You think you’re ready to take on the ownership of REP? Well, then we have just a few more practical pieces of advice for you in the rest of our Augur guide — make sure to read them all!

How to buy Augur token REP?

Let’s suppose you are ready to jump right into working and earning with Augur. Getting it directly from the foundation has not been possible since 2015. Of course, Augur crypto REP is available for trading on major exchanges against other cryptocurrencies, stablecoins, fiat currencies and more. But it requires some prior knowledge and a few additional steps if you are not a crypto trader already.

How to buy Augur token REP without these hurdles? Use ChangeHero! It’s extremely easy and you can trade it against any currency supported by the service. The exchange will be finished in just a few minutes and the funds will arrive straight at your wallet address, as ChangeHero is a non-custodial instant cryptocurrency exchange.

Where to Keep REP?

REP is a ERC-20 token. It is currently supported by most wallets, from the go-to ETH/ERC-20 wallets MEW (MyEtherWallet) and MetaMask to hardware Trezor wallet.

- Trezor is a great option for active Augur users. All devices support the token, and in the Trezor Beta client you can also swap REP with ChangeHero’s instant exchange option.

- Another option for a software that is available for free to all would be Exodus wallet. It has a huge list of supported assets, including REP, as well as a similar built-in exchange option powered by ChangeHero.

How to exchange REP with ChangeHero?

How to buy Augur token REP using ChangeHero? In five simple steps:

- Choose the currencies on the home page, amounts and the type of exchange. Provide your REP wallet address in the next step and check the amounts;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send in a single transaction the sum of cryptocurrency you will be exchanging. For Fixed Rate transactions you have 15 minutes before it expires;

- From here on, you won’t need to do anything. At this step we are doing all the work: checking the incoming transaction and making the exchange as soon as the funds arrive;

- As soon as the exchange has been processed, your REP is on the way to your wallet. Congratulations, it’s done! A review would be appreciated :)

Our support Heroes are there for you 24/7 in the chat on our website or through the email: [email protected].

Conclusion

That’s about it for this beginner’s Augur guide. Augur’s prediction markets are having a great moment right now, with the election happening soon. Who knows, how many Augur users will profit off their bets and who will get nothing? And more importantly, what will people be betting on when the election finishes? We can’t wait to see! Watch the crypto and blockchain news with us by subscribing to our blog and social media: Twitter, Facebook, Reddit and Telegram.