Have you heard of something called ordinals, digital artifacts, or inscriptions? Or something about (re-)emergence of NFTs on Bitcoin? Maybe even caught wind of the “new token standards” that look like ERC-20? The Bitcoin discourse these days is truly something else, so let us guide you through these new concepts and explain, what are ordinals and BRC-20 in Bitcoin.

Key Takeaways

- Ordinals is a system that designates satoshis according to their place in a block and the place of the block in the Bitcoin blockchain. It does not require a layer 2, side chain, or other protocol to work;

- The satoshis tracked by the ordinal system can have inscriptions: arbitrary data attached to them. These attachments can include up to almost 4MB of data, files, code, or media, thanks to the Taproot upgrade;

- Ordinals are controversial in the Bitcoin community. On the one hand, they are seen as an exciting new use case for BTC. On the other hand, they clog the blockchain, are hard to manage, and make BTC more expensive to use for everyone else.

Get Things in Order

What are Ordinals in Bitcoin? Generally speaking, the term “ordinal” refers to the designation of a place in an ordered sequence. “One” and “two” are cardinal numbers, and “first” and “second” are their ordinal denominations.

You don’t need to know the ordinal theory to understand Bitcoin ordinals. The units are tracked in an ordered sequence, hence the name. Bitcoin ordinals track satoshis, or the smallest unit of a bitcoin, 0.00000001 BTC.

How are they tracked? What is the sequence? This becomes clearer when we look at the naming convention of ordinals. An ordinal identifier would look like this: AºB’C’’D’’’, where:

- D’’’ is the index of a sat in the block;

- C’’ — index of the block in the difficulty adjustment period (2,016);

- B’ — index of the block in the halving epoch (210,000);

- and Aº — the cycle number. A cycle changes when difficulty adjustment and halving blocks coincide. The first event of this kind is expected in 2032.

Meaning an input with this index — 0°108630′774″48236699‴— tracks:

- A sat that is 48,236,699th in its respective block;

- This block is 774th after the previous difficulty adjustment;

- And also 108,630th after the previous halving;

- And of the first cycle. Sometimes this number is omitted.

If it sounds superficial… it is because it actually is. Ordinals are social and arbitrary. The sats remain identical to each other as long as the Bitcoin blockchain is concerned. Ordinals were meant to imbue sats with numismatic, or collectible, meaning.

A real-life analogy of this phenomenon would be a rare coin. As a currency, it has a nominal value: let’s say, $1. However, it can be of more worth to collectors due to being from a historic era of interest or having unusual circumstances around its minting. In this case, such a coin would be valued at more than $1, even though you still can spend it for its nominal value.

In its current form, the ordinal theory pertaining to the Bitcoin blockchain was formulated by Casey Rodarmor. He also proposed a system to grade the rarity of satoshis. Suggestions to track individual sats were made as early as 2012 in Bitcointalk topics. But it wasn’t until 2022 that a way to do it with extra flavor became a part of Bitcoin’s code.

Are Ordinals NFTs on Bitcoin?

Ordinals are often called NFTs on Bitcoin. It’s important to know that this is not because it is what they are. From the explanation above, you can probably already infer that an ordinal is not a token. However, this phrase stuck because it is the closest similar thing. Arguably, ordinals and inscriptions are even more interesting than non-fungible tokens on smart contract blockchains.

Speaking of inscriptions, what are they? This is exactly the “extra flavor” that can give a sat even more value. An inscription is an on-chain arbitrary message attached to a satoshi, which can contain text, media, code, files, and even software. The ordinal we used as an example above (0°108630′774″48236699‴) contains a clone of the classic shooter Doom.

The guide by CoinMarketCap’s Alexandria makes a brilliant analogy that makes inscriptions and ordinals easy to understand. A dollar bill signed by a celebrity has both a serial number and an autograph. The serial number does not necessarily make the bill worth more. However, the signature can make the value of the bill skyrocket.

The on-chain contents of inscriptions are a stark contrast to NFTs. The latter usually has enough space to contain only an external link to the content. Bitcoin ordinal inscriptions became possible thanks to the Taproot upgrade. But first, a brief history lesson.

True NFTs on Bitcoin? OP_RETURN and Counterparty

The early days of Bitcoin were rife with discussions about the future and purpose of the blockchain. For one, opinions were split on how the Bitcoin blockchain should be used. Some adopters believed it can serve as an immutable uncensorable data storage protocol and support a wider array of use cases. Purists argued that the blockchain cannot scale adequately to support anything beyond value transfer.

As a compromise, in 2014, Bitcoin developers added opcodes, including OP_RETURN, to the code. It supported the addition of messages with up to 80 bytes of arbitrary data to transactions.

OP_RETURN was widely used in Counterparty, a blockchain platform based on Bitcoin. It was used to issue non-fungible assets that were recorded in the Bitcoin blockchain with OP_RETURN messages. Collections of note include Spells of Genesis, a trading card game, and the original Rare Pepes.

Counterparty NFTs were a very niche use case. The heyday of opcodes was thanks to another protocol that issued assets on Bitcoin: Omni. Realcoin, which later became Tether USD, was initially launched on the Omni layer before migrating to Ethereum over 2018–2020. This is also when OP_RETURN use peaked. Even though even today it is not zero, there is now a better way to embed arbitrary data to Bitcoin transactions.

All New is Well-Overlooked Old

Long before Taproot, in 2018, the Bitcoin Core community activated SegWit or Segregated Witness. Before that, signature data was included in the transaction but to make it occupy less block space, the update separated signature data from the transaction data. This signature data in the witness field would not be counted toward the 1 MB block size limit.

Instead, witness data used block weight, so there were restrictions on the size of the signature. That is until Taproot further loosened these restrictions. It became possible to attach up to 4MB to a single Bitcoin transaction, which would occupy almost an entire block.

An inscription uses the taproot script-path spend scripts, meaning there are two steps to creating it. First, an inscription has to be added to the taproot script. Then, it has to be spent to appear on the blockchain. The contents are “wrapped” in an opcode-defined “envelope” so that the full nodes don’t have to validate the inscription in addition to the UTXO it’s attached to.

Inscriptions were possible even before SegWit but were costly and inefficient. With witness discount and lack of an upper limit on the witness data size (beyond the block limit), more types of attachments can be added to UTXOs.

So, is BRC-20 the Same as ERC-20?

As users realized the real extent of the diversity of inscriptions, something called BRC-20 emerged. It immediately evokes the connection with the ERC-20 standard: fungible assets on Ethereum governed by smart contracts.

The BRC-20 experiment was started by domo in March 2023. The author stresses that this is only an experiment, and the BRC-20 token design can be useful to mint these tokens, not imbue them with value. In this case, an inscription is a JSON file that is stored on-chain. This file has mint and transfer functions and is able to keep track of the state of the “contract”. Ultimately, it is an experimental attempt at bringing fungible tokens to Bitcoin, and domo admits that Taro and other side-chain standards are better implemented.

BRC-20 is by all intents and purposes not the same as ERC-20. It does not rely on the security of the underlying blockchain. The user experience is convoluted and poor since you can feasibly interact with this “standard” only with a few centralized services. This is what makes it more surprising that these inscriptions caused a surge in Bitcoin transactions to previously unseen levels.

Any Publicity is Good Publicity: the Controversy

It wouldn’t be an understatement to say that ordinals caused a stir in the Bitcoin community. After all, this is a new, unexpected use case that outdoes NFTs and incidentally, brought a lot of activity to the network. It was enough to reignite the debate about how Bitcoin’s blockchain should be used.

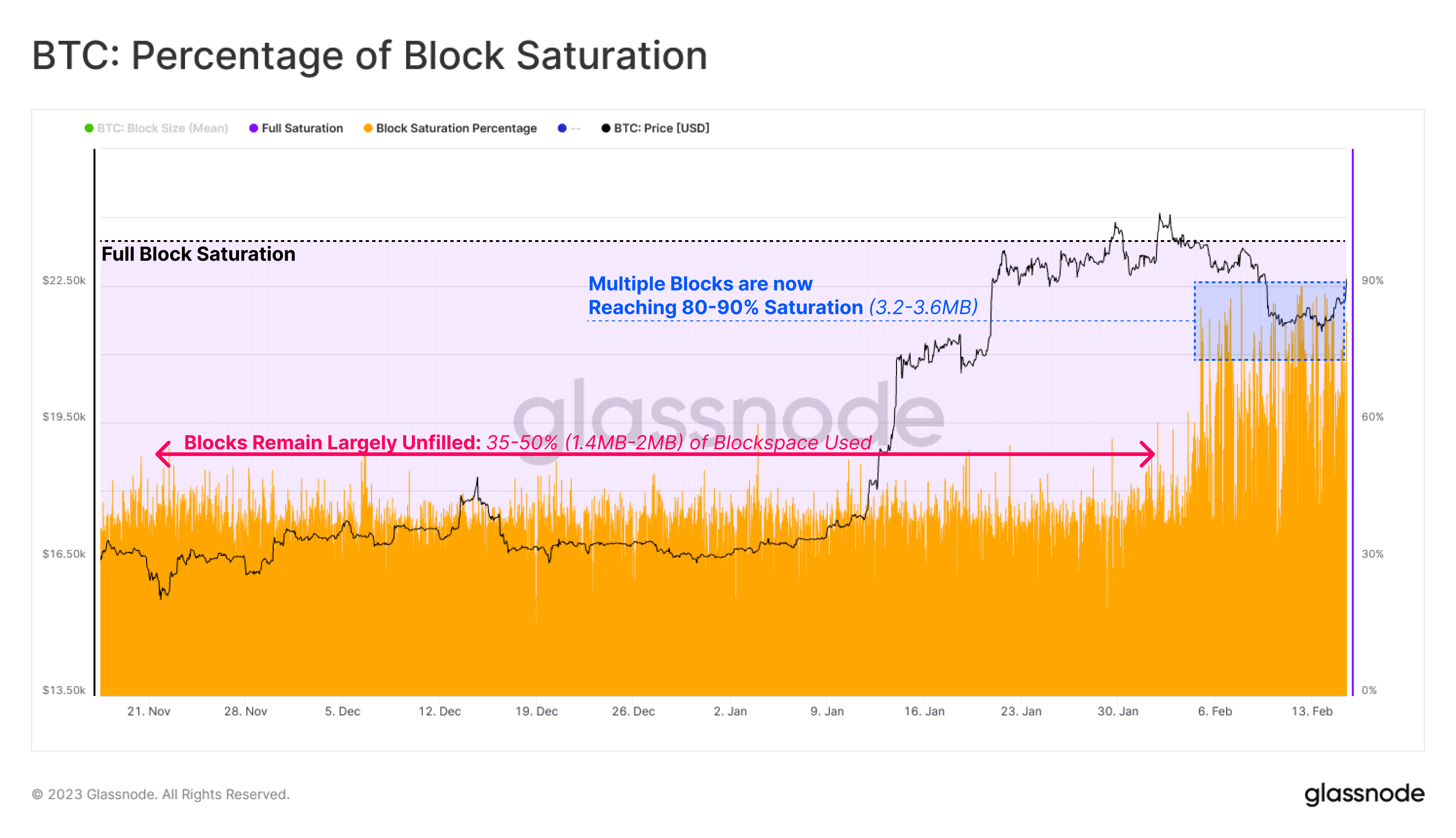

For one, it is already putting pressure on the transaction fees, raising the floor for everyone using BTC. This provides an argument for those Bitcoin maximalists who think non-financial uses of the Bitcoin blockchain put an unnecessary preventable strain on the network. On the other hand, others see this as a positive factor for block space demand. The block saturation has grown, meaning that miners are now producing larger blocks.

Block space is a resource that cannot be stored, so there is not much use in keeping blocks unfilled. However, as long as value transfers are concerned, ordinals might as well be low-value spam. Not to mention, miner revenues have not meaningfully increased, possibly opening them up to collusion and extracting value.

Last but not least, the digital artifacts (that inscriptions and ordinals are) possess a few qualities that NFTs don’t. They are immutable and uncensorable: their contents cannot be changed and it gets recorded onto Bitcoin’s blockchain for good. On the surface, this sounds perfectly in line with the ideals of cypherpunks. But it would also mean that illegal content and malware can make its way there. All while the “tainted coins” problem is still something Bitcoiners argue about.

How to Manage Ordinals?

To illustrate the claims made about the user experience with Ordinals, let’s see how you can avail of them. As we have mentioned, it is a system that doesn’t have a connection to Bitcoin on the protocol level. Not any Bitcoin software or wallet will support inscriptions and ordinals.

To receive and view digital artifacts, the Sparrow wallet will be enough. Users should be careful with sending transactions with this software because even though it has the option to freeze UTXOs, it has to be enabled manually.

More options include the Ordinals wallet, Xverse, and Hiro. The latter two let you create inscriptions without a full-node client through a middleman (Gamma.io, a Bitcoin NFT marketplace). This method is fine for text and media inscriptions but not advised for BRC-20 “contracts”.

For the full-fledged experience, installing a full node and Ord is recommended. Make sure you are prepared to store a 500 GB copy of the entire Bitcoin network on your device. This setup will allow you to create inscription content yourself, in addition to managing these digital artifacts.

And if you think that this part is not very different from storing and trading NFTs, you should know that there is no established marketplace for this type of asset. Ordinals are currently mainly traded over the counter in Discord servers (such as this one). It entails a high degree of unreliability and makes due diligence more complicated; exercise extreme caution should you decide to trade this way.

Conclusion

There is no consensus on the impact of ordinals and inscriptions yet. Some view it as a fun gimmick that revitalized the Bitcoin community, others earnestly trade it, and to the third cohort, this is a bona fide attack on the integrity of Bitcoin. The initial hype is winding down, and they may fade out of relevance unless more use cases and infrastructure are created. Love it or hate it, the invention of ordinals is a truly exciting development to witness.

Did you find our guide helpful or insightful? Let us know on Twitter, Facebook, Reddit, and Telegram. Subscribe to ChangeHero on the social media of your choice for daily updates and even more content. If you feel like deepening your knowledge about crypto with more guides like this one, check out the ChangeHero blog!