Mere days remain until the Bitcoin halving that is expected to take the BTC price 600% within the next year and a half. Does it affect the market today? Has the sentiment change affected the Bitcoin forecast in comparison to a year ago? Let’s see what the experts think about it and draft a Bitcoin price prediction for 2024, as well as the years to follow.

Bitcoin Price Prediction: 2024 to 2034

- There seems to be a correlation between the market trends and sentiment with the future price targets in Bitcoin price predictions. The all-time high price of Bitcoin has also moved up since last year to nearly $75,000.

- Moderate Bitcoin price prediction from 2024 diverges from past forecasts but both ultimately see Bitcoin grow beyond $100,000 in the next decade.

- Bullish Bitcoin price prediction has got even more daring: $2,500,000 maximum for a single Bitcoin. The current ATH is way below the projections promised by Bitcoin mega-bulls.

Bitcoin: An Overview

Bitcoin has been the largest cryptocurrency on the market from the very start and arguably served as its cornerstone.

The whitepaper for Bitcoin was published in 2008, though it had been in the works for quite some time by then. In this document, it is described as a peer-to-peer digital currency and envisioned as an alternative to cash fiat money.

Genesis (#0) block was mined by the Bitcoin creator(s?), Satoshi Nakamoto, on January 3, 2009. Since then, it has grown into a massive movement and a diverse community and inspired the many altcoins that now form the crypto market.

For more information, check out our Beginner’s Guide to Bitcoin. Alternatively, for an introduction to Bitcoin in Plain English, read the Crypto Basics series by the ChangeHero team.

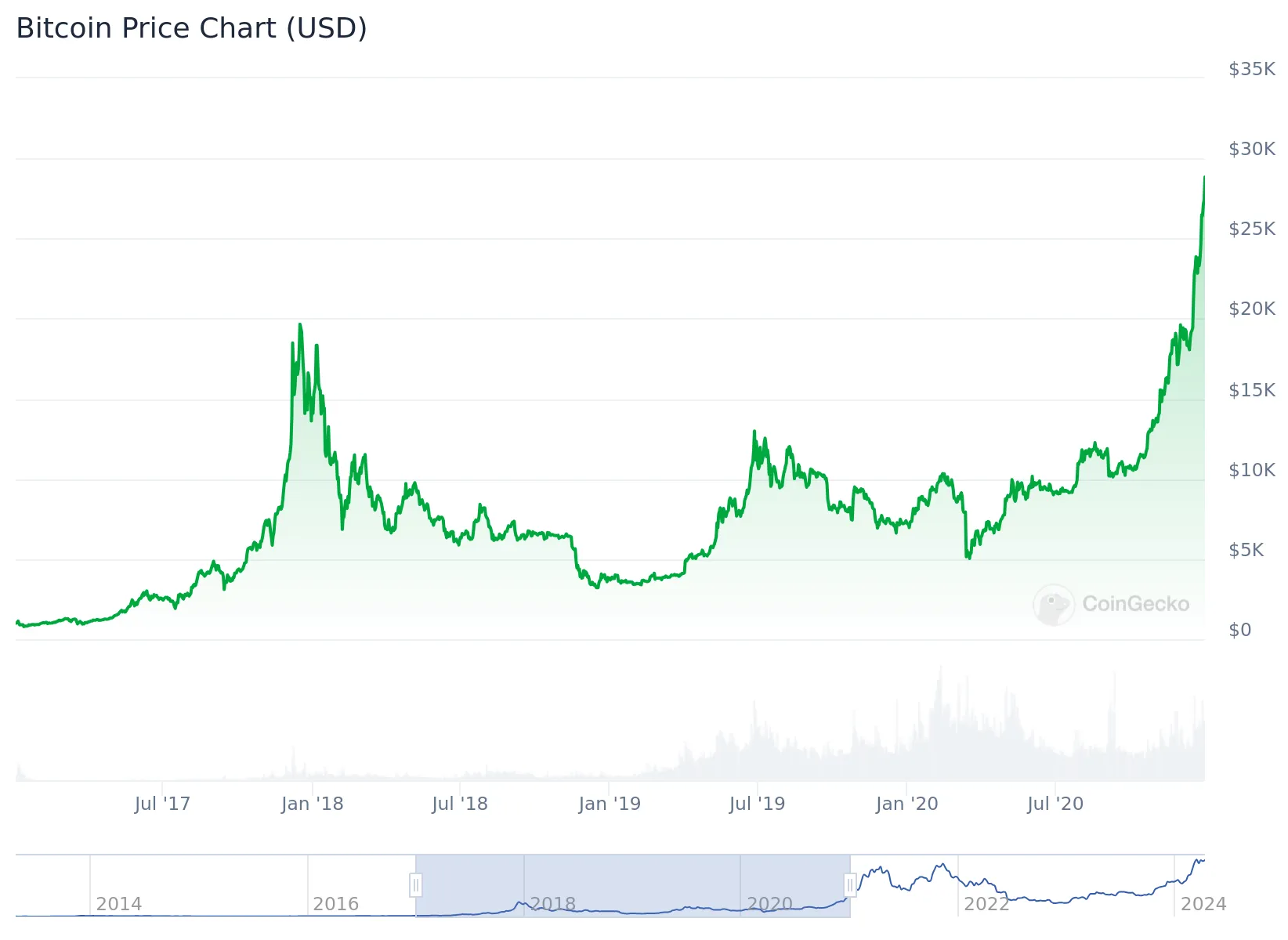

Bitcoin (BTC) Price History

Bitcoin was designed so that its worth is determined by the market, not by any central authority. In its earliest days, for example, when there was no market, its users determined its worth.

At one point it was around 0.00005 in Papa John’s pizzas. (This is, of course, in reference to the post on bitcointalk.com, published on May 18, 2010. User laszlo has offered 10,000 BTC to a stranger kind enough to buy him a couple of pizzas.) May 18 is now known as Bitcoin Pizza Day, and Bitcoin Pizzas are sometimes used to illustrate the growth in BTC’s price.

Bitcoin Price in 2009–2013

Until 2010, before BitcoinMarket.com was created, there was no market to trade cryptocurrencies and all trades were peer-to-peer. Since then, slowly but surely, Bitcoin has set a framework for the crypto market.

The first miner reward halving happened on November 28, 2012. At that time, Bitcoin was traded at $12.22 USD. The halving event itself had no immediate effect, neither on the price nor the network. However, a year later at the highest point of the bull market, Bitcoin cost $1,178. That is an almost 10,000% growth!

Its value was increasing, and by 2013 BTC was already being accepted by some real-world merchants. The interest in Internet technologies, such as digital payments, was on the rise. Cypriot financial and Greek government debt crises have also been connected with rising interest in Bitcoin.

In retrospect, throughout 2013 Bitcoin seems to have been relatively stable. That is, until late in the year: in October an unprecedented rally began, taking BTC to parity with gold at $1,250. The market was still extremely volatile and, obviously, the correction followed suit.

BTC Price in 2014–2016

The downtrend in Bitcoin and the crypto market was exacerbated by the Mt. Gox shutdown and false reports of the ban on BTC in China. It reversed only in mid-2014. The year closed with the Bitcoin price sitting at $300.

But this was only the beginning of Bitcoin’s rise. During the following two years, it was steadily gaining value, with a few spikes in November 2015 or June 2016. The late 2016 rally was connected with the Chinese Renminbi depreciating against USD. However, it’s even more likely that the rally in 2016 was not under the influence of external economic factors. As the market matured, internal factors like the July reward halving for BTC started having more effect. Between 2015 and 2016, Bitcoin’s price almost tripled, from $315 in January 2015 to $973.99 in December 2016.

BTC Price in 2017–2020

In August 2017, the Bitcoin Cash fork occurred. It was a result of a long-standing scaling debacle. The part of the community that was in favor of increasing the block size to help scale the network decided to split off.

However, this was a blip in comparison to what happened next. The rally gained the attention of more investors, and over the following six months, it only accelerated.

There were setbacks, like a crackdown on initial coin offerings (ICO) and exchanges in China in September 2017. This caused a sharp dip to $2,900. Regardless, the trend persisted, and on December 17, 2017, Bitcoin reached $20,089. The correction, expectedly, followed suit, fuelled by the network congestion and rising fees, exchanges being overloaded and investors terrified of a bubble burst.

This brought regulators in, and fears of intervention and manipulation accelerated the onset of the bear market. Some have called 2018 the worst year for Bitcoin at the time: it lost 70% of its value, closing at $3,747, in comparison to opening at $13,062.

But obviously, the “crypto winter” (the depression of 2018 and the bear market of 2019) was not the end. The entire market entered a stage of recovery, and the once-lost interest of the public was returning. News about central-bank-issued digital currencies (CBDC), most notably, digital yuan, launch plans for TON and Libra (Diem) created price fluctuations. In the long term, the returning interest contributed to the bullish trend.

In 2020, other outside factors stepped into the game. The COVID-19 global pandemic caused a stock market crash, which culminated on March, 12. Bitcoin’s price dropped by almost half (open: $7,913.62 vs. close: $4,970.79). After that, on May 11, 2020 mining rewards were halved yet again.

Investors were getting ready for history to repeat, and even institutional investors came in with the capital. This was said to be one of the driving factors of the Bitcoin bull run that followed.

Bitcoin Price in 2021–2024

And repeat it did! After reaching the $60,000 milestone in May, Bitcoin price took a nosedive but over the course of summer recovered and consolidated. A second peak price of the bull run was reached on November 10, 2021: $68,789.63.

Analysts were confident that the next goal for BTC price would be the coveted target of $100,000. Unfortunately for them, this would be the farthest the bulls would go. 2022 turned out to be another bad year for Bitcoin investors and the crypto market at large.

To make the subsequent correction worse, a few major events took the BTC price down even further along the way. First, one of the major altcoins at the time, a stablecoin of Terra (LUNA) lost its peg and triggered a bank run that drove the whole blockchain platform down to almost zero. Then, crypto companies that had exposure to Terra’s tokens and DeFi products started to suffer, namely crypto lenders Celsius and Voyager. When things seemed to have calmed down, the truth about FTX surfaced and caused it to collapse, making the crypto landscape even more precarious to outsiders and regulators. After all of these events, at the end of 2022, BTC was worth $16,600.

In hindsight, that mark looks like it has been the bottom for the price of Bitcoin. With a few rare exceptions, it has mostly been going up. The prevailing trend of Bitcoin in 2023 was to the upside, building up the trust and perceived value back. This yielded the most ostensive result in early 2024 when the U.S. Securities and Exchange Commission finally approved 11 spot Bitcoin ETFs. The news was deemed so bullish and the cash flow proved to be so effective that the Bitcoin price reached a new all-time high on March 14, 2024 — $73,737.94.

At the moment of writing, the market cap of Bitcoin is $1,348,102,118,464. With 19,678,850 BTC in circulation, that makes the current Bitcoin price $68,683.02 (data from CoinGecko).

What Influences the Bitcoin Price?

Miner Reward Halving

In brief, “halving” is a preprogrammed event that reduces the block rewards in half, hence the name. It does not affect the existing supply but slows down the rate at which new bitcoins are minted. Historical price analysis claims that there are observable market cycles tied to the Bitcoin halving events. The supply rate growth slowing down makes the demand and price skyrocket.

The previous two halvings have triggered a long-term bull run for BTC and the entire cryptocurrency market. More can be read in our article on Bitcoin halving. The crypto community is currently watching the date of the next BTC halving: April 19, 2024. After block #840000, each new one will grant the miners only 3.125 BTC.

There are a couple of contradicting theories on the bullish nature of halvings. On the one hand, halvings significantly reduce issuance and inflation rates. Miners actively sell off freshly minted Bitcoins, so when the supply is cut down, the price rises. On the other hand, halvings don’t have a lasting effect on the network, meaning these events are priced in.

Effects of Adoption

Before the retail boom, Bitcoin was mostly owned by those who would come into the game knowing the rules. Once the hype kicked in, retail investors flooded in but, unprepared for the shakiness of the market, suffered losses. That was before any comprehensive regulation was in place. Setting rules for the game and ensuring the participants respect them is the key to adoption.

In 2021, Bitcoin received a legal tender currency status in El Salvador, massively boosting its scope of real-world adoption.

But in reality, as history shows, it’s not always this fine and dandy. Despite the claims that Bitcoin does not need a trusted authority to work, prohibitive regulations can damage its standing. For example, in May 2021, China finalized a complete ban on cryptocurrency trading and completed the crackdown on miners. As a result, Bitcoin price sank from $60,000 to below $34,000 but as the miners moved out, the hash rate and the price recovered.

Perhaps, not all adoption is equally effective for Bitcoin’s price. The 2018 rally is said to have been fuelled mostly by retail traders. It was different in 2021 when large players joined the game. This time around, with even more professionals exposed to Bitcoin through ETFs, industry insiders believe the upcoming bull run will see less volatility and more value build-up.

Additional Factors

These days, these factors have less influence on Bitcoin’s price but at the time, they caused significant price fluctuations.

In May 2021, when the first pullback in the Bitcoin bull run happened, the CEO of Tesla Elon Musk announced on Twitter that the car manufacturer would not accept BTC for payments citing mining’s impact on the environment. Since then, efforts to bring awareness to the use of sustainable energy in Bitcoin mining have been made. El Salvador is building Bitcoin mining facilities that will utilize geothermal energy. American miners, who now account for the majority of the hash rate in the network, established the Bitcoin Mining Council to provide transparency to the operations and educate responsible regulators on the nature of Bitcoin and crypto.

Updates to Bitcoin’s protocol also can shift the sentiment. The latest major upgrade in BTC occurred in November 2021 — the so-called Taproot upgrade. Thanks to it — love it or hate it — we have the Ordinals protocol, which made waves in the Bitcoin community and network. On release, Lightning Network also caused some hype and was thought to be a major driving force behind the mass adoption of BTC payments. It was cited as a factor that would drive Bitcoin prices to $250,000 in 2023 but as we see today, it was too optimistic.

Bitcoin Price Analysis and Forecast

With the fundamentals described above in mind, let’s see what technical analysis can tell us. It is not yet clear whether April disrupts the green months’ spree or continues it but for now, we will assume that the current ATH is not to be overtaken soon. In the previous bull run, BTC ran up against the $60,000 level a few times, establishing a significant level that will most likely act as a support, should it pull back now.

Even though for more than half a year now BTC’s price has been rising, the relative strength index (RSI) suggests that the bullish momentum has not been exhausted yet. The crossover with its simple moving average is bullish and the RSI itself has just treaded into the overbought area.

Bitcoin Price Prediction 2024

AMB Crypto ponders both bullish and bearish scenarios for BTC. At the very least, BTC’s minimum price will not go beyond $40,000. In a month, its average price is expected to be $65,630 and at most, BTC can reach a maximum price of up to $70,224. By pushing through the resistance levels near $70,000 and $75,000, Bitcoin’s price can reach $83,000 and shoot for the range between $100,000 and $150,000.

Coinpedia seems to have more faith in Bitcoin bulls, and their forecasted average trading price of Bitcoin in May 2024 is $71,000. It is derived from the minimum price of $60,000 and the maximum price of $79,000. The absolute maximum for BTC to reach in the remainder of 2024 is $120 thousand, although, in the worst-case scenario, it can dump no lower than $35,000.

For his YouTube Bitcoin price prediction, Crypto Jebb uses crypto signals and shows how BTC’s price gained 10% to 50% each time. Since a similar signal flashed this Monday, he expects Bitcoin to surge past $78,000 up to $108,000 maximum in the coming weeks.

Past Bitcoin predictions for 2024: $27,214.69–74,967.47.

Bitcoin Price Prediction 2025

If we are sticking to the market cycle hypothesis, then 2025 will be the year when the bull run peaks. Where do the experts put targets for it, considering this possibility?

Renowned trader Peter Brandt has long been interested in Bitcoin as a promising digital asset. Recently, he revised his 2025 BTC prediction — at the bull market peak, BTC has the potential to reach $200,000.

Algorithmic services such as BitNation can produce unexpected results. However, this Bitcoin forecast is more or less in line with the experts’ estimations. In 2025, the average price of BTC will come up to $248,294, calculated from the minimum and maximum prices of $156,070.81 and $198,635.58 respectively. Their past predictions for Bitcoin in 2023 are still up: its average was expected to reach $106,411.92 last year.

Humans are more likely to predict a wider range for the future price of Bitcoin. This is the case with the BTC forecast of CryptoNewsZ: to cover more possibilities and volatility, they provide a minimum price estimate of $83,150 and a maximum price prediction of $155,758.

Past BTC predictions for 2025: $106,000–1,000,000

Bitcoin Price Prediction 2026–2029

By now, we can already infer from the BTC price predictions above that in five years, it can multiply in price. With that in mind, let’s see what forecasts are out there for 2029 and up until then. Apparently, once the $100,000 hurdle is cleared, nothing is off the table.

| Year | Digital Coin | PricePrediction.net | Wallet Investor |

| 2026 | $206,541.55–255,805.32 | $189,651–225,648 | $50,311.05–81,970.53 |

| 2027 | $269,576.45–321,617.35 | $254,824–325,187 | $49,571.63–87,202.40 |

| 2028 | $269,576.45–321,617.35 | $352,967–437,256 | $47,782.43–90,201.71 |

| 2029 | $332,620.98–379,853.37 | $507,214–608,155 | $49,285.40–94,303.53 |

Bitcoin Price Forecast for 2030 and Beyond

Analytics and media outlet Finder surveyed a panel of crypto industry experts about their expectations for Bitcoin’s price in 2030. The average result comes up to $366,935. This is somewhat more moderate than the 2022 survey when the average price prediction was $406,400 but is more optimistic than 2023 one: $188,451.

Per the daring ARK Invest report called Big Ideas 2024, past five years from now, Bitcoin’s value can reach $120,000 should 1% of the global investable asset base end up in it. With a 4.8% average allocation, the fully diluted BTC would be worth $550,000. The maximum Sharpe-ratio-justified 19.4% allocation of this asset base would make 1 BTC worth a whopping $2.3 million a piece.

As for ten years in advance, such a long-term price forecast is even more prone to imprecision. Analysts and algorithms still try: Coin Price Forecast gives a guesstimate of $407,009–423,659 for 1 BTC in 2034. Jurrien Timmer, the Director of Global Macro at Fidelity Investments, believes the value of a single Bitcoin could reach $1M by 2030 and $1B sometime between 2038 and 2040. Finally, Bitcoin evangelist Chamath Palihapitiya says that the true value of BTC is closer to $100,000 but past 2040, it can already be more than a million.

Past BTC Forecast Prices in 2030: $500,000 (Winklevoss twins) — $12,000,000 (Robert Breedlove)

How to Exchange Bitcoin on ChangeHero?

ChangeHero is your one-stop shop if you want to swap altcoins for the first cryptocurrency or even buy Bitcoin with a credit or debit card.

To exchange crypto with Bitcoin:

- Choose the currencies on the home page, amounts, and the type of exchange. Provide your BTC wallet address in the next step and check the amounts;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send the cryptocurrency for exchange in a single transaction. Fixed Rate transactions have a 15-minute limit;

- From here on, we are doing all the work: checking the incoming transaction and making the conversion as soon as it arrives;

- As soon as the exchange has been processed, your BTC is on its way to your wallet. Congratulations! We’ll be happy to hear your feedback.

If you want to buy Bitcoin with a bank card, you can also do it on our website.

- Choose the country of residence, the amount to buy, and the currencies. Proceed to the next step;

- Check the currency of purchase and amounts. Provide a BTC address;

- In the next steps, verify your phone address and card info. Pass 3D-secure verification;

- Finally, to make a purchase pass the identity verification with a state-issued ID and a selfie.

For full instructions on how to buy Bitcoin, check out the guide with step-by-step instructions.

Conclusion

The future price of Bitcoin is a subject of much debate and speculation since it also reflects the future of the digital asset market at large. Whether you hold altcoins or not, Bitcoin’s future concerns everyone who is invested in crypto, and for now, it sure seems to be bright.

Do you have an opinion on our Bitcoin price prediction or a forecast of your own? Share them in the comments on our social networks: X, Facebook, Reddit, and Telegram! Stay tuned for updates to the Bitcoin price prediction and explore more crypto assets with our blog.

Frequently asked questions

What will Bitcoin be worth in 2025?

BTC can be trading for between $83,150 and $248,294 as soon as 2025, according to various sources.

How much will 1 Bitcoin be worth in 2030?

Depending on the source and method, a 2030 Bitcoin price prediction estimates the BTC price to be between $120,000 and $2,300,000.

How high will Bitcoin go in 2024?

Different sources put Bitcoin 2024 targets in a wide range between $35,000 and $150,000.

What will be the value of Bitcoin in the next 5 years?

Some analysts predict Bitcoin will rise in value up to $608,155 by 2029. The lowest estimate for BTC in 2029 is put at $49,285.40.

Will Bitcoin reach $10 million?

Some methods used to forecast the Bitcoin price show that BTC has the potential to exceed $1 million in a decade. The highest Bitcoin price prediction past 2030 has the maximum price of one bitcoin be $2.3M.

Will Bitcoin skyrocket again?

There is a strong consensus on Bitcoin’s price going up going forward. However, opinions diverge on the intensity of this growth.

Disclaimer

This article is not a piece of financial advice. No price prediction is guaranteed to provide exact information on the future price.

When dealing with cryptocurrencies, remember that they are extremely volatile and thus, a high-risk investment. Always make sure to stay informed and be aware of those risks. Consider investing in cryptocurrencies only after careful consideration, analysis, and your own research.