Bitfinex cryptocurrency exchange plans to raise $1 billion in Tether (USDT) via initial exchange offering (IEO).

An Initial Exchange Offering (IEO) is the crowdfunding strategy that enables crypto projects to fundraise directly on exchanges. IEO token sale is not open to the general audiences, in contrast with ICO. You need to be an active user of a particular exchange to buy tokens.

Binance was the first to offer catering services for Initial Exchange Offerings. Now other exchanges have joined the effort, for example, Huobi has launched their project lab Huobi Prime on March 26 to compete with Binance’s Launchpad.

Zhao Dong, a shareholder of cryptocurrency exchange Bitfinex, has released promotional material detailing the exchange’s upcoming initial exchange offering for up to $1 billion in a tweet on May 4.

Bitfinex LEO Tokens offering

The “Initial Exchange Offering of LEO Tokens” document was released on May 8 by iFinex announces the availability of up to 1 billion USDT worth of the exchange’s tokens, dubbed LEO, for purchase. It intended to be the utility token at the heart of the company’s ecosystem.

LEO token holders will enjoy reduced crypto to crypto trading fees on Bitfinex, decreased lending fee reduction, withdrawal and deposit fee discount, derivatives fee reduction, etc.

The token sale is being conducted in order to cover $850 million of the exchange’s funds, which are currently frozen in multiple accounts under the control of a payment processing firm.

On April 25, New York City Attorney General’s Office (NYAG) Letitia James filed a lawsuit against iFinex, claiming that Bitfinex was using $900 million taken from Tether’s cash reserve in an attempt to “hide” its losses of $850 million.

The NYAG office reported that Bitfinex sent $ 850 million to a “bank” from Panama called Crypto Capital Corp, which allegedly provided banking services to various crypto exchanges that struggled to get services from major financial institutions.

Ultimately, Bitfinex was reportedly unable to recover $850 million, which was sent to Crypto Capital Corp, which probably resulted in the company receiving a loan of $900 million from Tether.

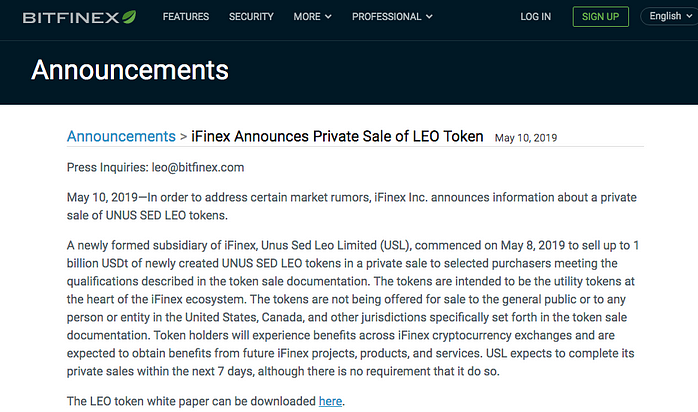

iFinex Inc. announced a private sale of UNUS SED LEO tokens

Yesterday, on May 10, 2019, in order to address certain market rumours, iFinex announced information about a private sale of UNUS SED LEO tokens:

“A newly formed subsidiary of iFinex, Unus Sed Leo Limited (USL), commenced on May 8 to sell up to 1 billion USDT of newly created UNUS SED LEO tokens in a private sale to selected purchasers meeting the qualifications described in the token sale documentation. The tokens are intended to be the utility tokens at the heart of the iFinex ecosystem. The tokens are not being offered for sale to the general public or to any person or entity in the United States, Canada, and other jurisdictions specifically set forth in the token sale documentation. Token holders will experience benefits across iFinex cryptocurrency exchanges and are expected to obtain benefits from future iFinex projects, products, and services. USL expects to complete its private sales within the next 7 days, although there is no requirement that it do so.”

According to the Bitfinex white paper, LEO tokens will be sold in a private offering only, outside of the United States without the means of general solicitation or general advertising. LEO presents a sizeable opportunity for existing iFinex users and those who wish to use iFinex’s platforms and services.

On a monthly basis, iFinex and its affiliates will buy back LEO from the market equal to a minimum of** 27%** of the consolidated gross revenues of iFinex (exclusive of Ethfinex) from the previous month, until no tokens are in commercial circulation. Repurchases will be made at then-prevailing market rates. LEO tokens used to pay fees may also be used to satisfy this repurchase commitment. An amount equal to at least 95% of recovered net funds from Crypto Capital will be used to repurchase and burn outstanding LEO tokens within 18 months from the date of recovery. Further, an amount equal to at least 80% of recovered net funds from the Bitfinex hack will be used to repurchase and burn outstanding LEO tokens within 18 months from the date of recovery.

What is unusual with Bitfinex IEO?

The main point is that Bitfinex apparently rising funds mainly for **covering its losses **and avoiding lawsuits by the US government, then for the ecosystem development. It is a whole different story than a regular IEO raising money to start or develop their project.

Even though Bitfinex is one of the largest exchanges in the world, the history and rumour surrounding Tether (USDT) and their IEO could potentially worry investors.

Hopefully, LEO tokens will bring real value to the Bitfinex investors and crypto community overall. The ChangeHero exchange team would be happy to have LEO token on board in the near time.

We publish interesting content on our blog. Follow us on Twitter, Facebook, Reddit, Telegram and Medium and be up to date!

Learn more:

Quick links:

- Exchange Ethereum to Bitcoin

- Exchange Bitcoin to Ethereum

- Exchange Bitcoin to Bitcoin Cash

- Exchange Bitcoin Cash to Bitcoin

Disclaimer:

The material provided herein is for informational purposes only. These materials should not be taken as financial or legal advice. Use this information on your own purpose only after careful analysis, research and verification. This Content may not be considered a suggestion or guide to action.