While all eyes are on Bitcoin and its new price record, the second cryptocurrency is also prime for an opportunity to break its all-time high. In fact, it is almost a certainty and the only question is how high can the price discovery of Ethereum (ETH) extend. We compiled this Ethereum price prediction based on the community voices, news, and expert opinions.

Summary of the Ethereum Price Predictions 2024–2034

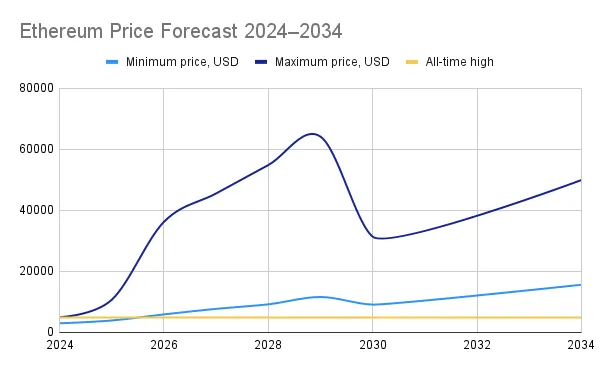

- The question of Ethereum beating its ATH is not if, it’s when. Even moderate forecasts see it happening sometime in 2025 or 2026, and bullish ones aim for price discovery this year already.

- According to moderate estimates, ETH can reach five figures even before 2030. Such growth will be sustained thanks to the value provided by the blockchain technology used in the Ethereum network, and more importantly, its ongoing development.

- As for the bullish predictions, Ethereum can aim beyond $50 thousand in just a few years from now.

What are Ethereum blockchain and Ether (ETH)?

Ethereum is a decentralized platform that was envisioned as a “global computer” by Vitalik Buterin. It was built to support smart contracts that let the users execute agreements without any intermediaries and more complex applications. Today, decentralized applications (dApps) built on the Ethereum blockchain form the ecosystems of decentralized finance (DeFi), blockchain gaming, and more.

Ether (ETH) — often called Ethereum — is the native currency of the platform. It is primarily used for paying transaction fees as well as a means to sustain the network.

The merge and transition to Proof-of-Stake previously was known as Ethereum 2.0. After the merge, instead of mining, Ethereum is secured by staking. This version will have better scalability on the base layer, too, and the merger was finally finished in 2023.

A deeper dive into the exciting world of Ethereum’s technology and Ether’s value can be found in our Beginner’s guide to Ethereum.

Ether Price History

ETH Price in 2015–2018

In its first years of existence, Ethereum was pretty much a work in progress. All was going well until in June 2016, the DAO was hacked and bled $150 million. The ETH price reacted by dropping from $18 to $10. This has also led to Ethereum Classic splitting off, which retains the ledger that did not roll back the hack.

Once the smart contracts were ready for deployment and use in 2017, Ethereum became a launchpad for ICOs. At the start of that year, the ETH price was only about $7. The technology to quickly program tokens for every purpose led to a boom in the novel fundraising scheme.

This boom accelerated the bull run of Bitcoin and the crypto market. Ether also skyrocketed to $1,342.73 at its peak in January 2018. Later that year, the cycle ended with a correction, ETH bottomed at $130, and a two-year-long “crypto winter” began.

ETH Price in 2019–2021

In 2019, Ethereum’s price opened and closed at around $125 for a coin. While the price stabilized, the platform was covering more and more use cases: it found an application in DeFi with stablecoins. Decentralized exchanges powered by smart contracts gained traction, and the blockchain gaming sector grew. In 2020, the DeFi sector exploded, and Ethereum accounted for more than 90% of all the projects and value in the sphere.

Despite the hype around the new financial products, Ethereum did not go on a rally until very late in the year. For most of the year, it was in a slow long-term uptrend, climbing from $130 to $600. However, in December 2020 and in 2021, Ethereum has been rallying thanks to Ethereum 2.0. The long-anticipated upgraded network was finally shipped to the mainnet, and the devs moved on to devise plans to merge the networks.

Meanwhile, the Ethereum price hit $4,362.35 in May 2021. The development and expansion of the Ethereum network were continuing, and Ether’s price after a brief pullback continued to rally. Another factor that contributed to the second run-up is the London hard fork in August. One of the changes it introduced was the new fee mechanics which reduced the inflation of ETH. Because of this, by November 15, 2021, ETH reached the current all-time high of $4,891.70.

ETH Price in 2022–2024

After that, the market overheated and turned to the downside in 2022. Several high-profile fiascos noticeably contributed to the downturn: in May, the Terra ecosystem folded, and in November, one of the largest crypto exchanges at the time, FTX, collapsed. By the end of this rough year, ETH arrived at the $1,200 mark.

If 2022 was the bear market, 2023 ended up being another crypto winter, the time of accumulation. Slowly but steadily the crypto market was recovering. Having started at $1,200, Ethereum’s price rose to $2,350 by the start of 2024. In contrast, 2024 so far looks a lot more bullish, starting with the news of a Bitcoin ETF approval.

At the time of writing, Ether’s price is $3,829.90. The cryptocurrency is second only to Bitcoin in terms of capitalization: $460,046,756,772 (18.4% of the total market cap).

What Affects Ethereum’s Price?

Tech updates

The Merge, previously referred to as Ethereum 2.0, was finished in 2023 with the Shapella upgrade, which unlocked the stakes. Even though the lull in the market seemed to have more effect on the Ethereum price than the news, it contributed to Ethereum’s growth during that year.

Even with the Ethereum 2.0 and Merge narratives out of the picture, the network will keep receiving updates. Tangible steps in the direction of solving the scalability and sustainability issues are finally being made on mainnet. Next up for Ethereum is the Dencun (Deneb + Cancun) upgrade that will introduce so-called “protodanksharding”. In practice, it would mean significantly lower L2 operation fees.

It seems that for now, the Ethereum network will have to rely on layer two solutions, as Vitalik Buterin said years ago. The teams behind OMG Network and Polygon were the first to implement some of them but by now, the L2 landscape looks different. Rollups became the most popular type of scaling solutions: optimistic rollups power Arbitrum, Optimism, and Base, while zero-knowledge rollups are present in zkSync Era and Starknet.

The Dencun upgrade, which is expected around March 13, 2024, can become the impulse that carries the Ethereum price forward to new highs.

Use Cases

Even in 2024, the Ethereum platform still dominates DeFi, and many of its proponents see a promise of future value increase. More than that, ETH is simply needed to pay the “gas” fee for the transactions on the platform. In addition, stablecoins are attracting a lot of attention to the network. Some of the largest by market capitalization stablecoins at the moment are USDT, USDC, and DAI, all ERC-20 tokens.

In 2021, Ethereum-based NFT (non-fungible tokens) broke into the mainstream market. These days, there are way more blockchains to mint and trade NFTs but ERC-721 tokens still account for most of the NFT market, even after the advent of Ordinals.

Even though most apps and protocols on Ethereum these days make use of the L2 scaling solutions, gas is still paid in ETH. Rollups and other L2s make fees cheaper for the end user but also enable more users to join, which can lead to a rise in validator revenues as well. Positive network activity benefits all sides, increasing the utility of the Ethereum network.

Tokenomics

Back in 2021, the hard fork London changed Ethereum gas fee mechanics and with those, the ETH supply dynamic. Currently, the fee consists of a base fee, which is burned, and a tip, which goes to the miner. The fee market is still in place in a way but Ethereum is not as reliant on it as Bitcoin.

ETH burn has become an important factor in the dynamics of the cryptocurrency’s supply. After the update, the inflation rate of ETH quickly dropped below Bitcoin’s (1.11% vs. 1.75%).

At the time of writing, 4,113,687.1 ETH has been burnt. The busier the network is, the higher the deflationary pressure. And you better believe it’s busy: the current emission rate of ETH is in the negatives, which means it’s burned faster than mint.

The effect of disinflation is harder to observe than breakouts caused by the news. However, this factor still influences the Ethereum price in the background, slowly reducing the supply while the demand changes with the sentiment.

Ethereum Price Analysis & Forecast

From February onward, Ethereum has been going almost exclusively up. With how bullish and greedy the crypto market right now is, there is little doubt that it can carry on for a while. So for this analysis, we’ll focus on whatever little time there is left before ETH inevitably reaches the new ATH.

On the way there, it can stop and/or pull back to $3,977.85 and $3,334.19, as the relative strength index is in the overbought area.

Ethereum Price Prediction 2024

According to the fundamental analysis made by FXLeaders, there are a few factors currently in play in the Ethereum market. On the one hand, we have the short-term correction caused by the profit-taking in Bitcoin after its new ATH and altcoins. Delays in the Ethereum ETF decisions also skew the sentiment toward a bearish side. At the same time, Dencun’s anticipation amplifies the bullish sentiment that still dominates the market. With all this in mind, the range for ETH to move next lies between $3,300 and $4,000.

CryptoSlate goes further and puts the target at $5,000 in Q1 2024. They cite mostly the same reasons: Dencun upgrade and ETH ETFs. Both can accelerate the Ethereum price beyond the current ATH.

YouTuber Marzell Crypto breaks the news that ETH is actually outperforming BTC. Setting up a limit order around the support of $3,550 might be a good idea in case it goes down. However, should the Ethereum price move up, it should at least add 20% more and arrive near $4,000.

Ethereum Price Prediction 2025

Even a year later, ETH is still expected to push further, pulling back only for more buying opportunities. For example, Coinpedia forecasts the average price of ETH in 2025 will float around $4,421. Their maximum price target can seem conservative, though: only $4,925. Regardless, they don’t see Ethereum’s price dipping below the minimum price of $3,917.

In March 2025, exactly a year from now, Ethereum can be trading for $6,422.62, CoinCodex predicts. This falls close to the maximum forecast Ethereum price that year of $6,862.13. As for the lower bound, it can go as low as $3,749.97, potentially as the bull run ends.

Elliott Lee of Techopedia does not think it will end in 2025 but the peak of it should occur in Q4 2025, according to historical analysis. The maximum price of Ethereum that year can be as high as $10,700 but the least it should be worth is $4,500.

Ethereum (ETH) Price Prediction 2026–2029

If you intend to hold ETH for more than a year and are curious about the Ethereum price from 2026 to 2029, here are some estimates from different sources. Don’t be surprised: all of them are extra bullish on ETH!

| Year | CryptoNewsZ | Digital Coin | Captain Altcoin |

| 2026 | $5,915–8,515 | $11,338.47–13,958.93 | $36,233.98 |

| 2027 | $7,740–11,142 | $14,780.23–17,458 | $45,540.66 |

| 2028 | $9,213–13,263 | $14,780.23–17,458 | $54,847.33 |

| 2029 | $11,610–16,713 | $18,219.71–20,919.25 | $64,154 |

Ethereum Price Prediction 2030, 2034

Where Ethereum will go next in the short term is a burning question but experts also have a lot to say about the long-term future of this asset. Let’s review their opinions and read the arguments.

Using an original prediction model, Coin Data Flow forecasts that by 2030, ETH should be trading in the range of $9,125.20–$31,382.14. Continuing the same projected path, in ten years it will arrive somewhere between $15,628.28 and $49,932.98.

Not all analysts share the same degree of bullishness. Dominic Basulto, writing for The Motley Fool, pinpoints the target at which ETH will arrive by 2030: $10,000. He admits that this estimate is conservative, even though it would take a massive price move in only six years. Key factors in this would be scaling improvements and the spot ETF approval. After all, we are already observing how it did wonders for Bitcoin.

Finder went further and surveyed a panel of 40 industry specialists and experts. Summing up their opinions, they placed the average price of Ethereum in 2030 near $19,190. The reason it isn’t higher includes competition from L2s and other smart contract platforms.

How to Buy Ethereum (ETH) on ChangeHero?

To start using any of the apps in the Ethereum network or even tokens, you have to have some ETH. Getting your hands on it is as easy as ever, and swapping any crypto for ETH with ChangeHero can be done in a few easy steps:

- Choose the currencies on the home page, amounts, and the type of exchange. Provide your wallet address in the next step, and check the amounts;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send a single transaction in the cryptocurrency you will be exchanging. Fixed Rate transactions have a 15-minute limit;

- All done? Now we are doing all the work: confirming the incoming transaction and performing the exchange as soon as it arrives;

- Once the exchange has been processed, your PEPE is immediately on the way to your wallet.

Customer support is available 24/7 in the chat on the website or through the email: [email protected].

Need to buy Ethereum first or sell it with a bank card? That is also very easy to do on ChangeHero. Check out this guide for instructions!

Conclusion

Not everyone agrees on the extent of the lengths Ethereum will go this time around but the fact that new price records will be set is all but unanimous. Approving an Ethereum spot ETF makes even more sense than for Bitcoin, and on top of that, we have protodanksharding coming — plenty of things to look forward to as soon as this month!

How did you like our Ethereum price prediction? Let us know on X, Facebook, Reddit, and Telegram. Find even more educational and informative articles on the ChangeHero blog.

Frequently Asked Questions

What will Ethereum be worth in 2025?

By 2025, analysts expect ETH to be trading between $3,917 and $10,700.

How much will 1 Ethereum be worth in 2030?

Various sources give estimates in the range between $9,125.2 and $31,382.14 for Ethereum in 2030.

What will be the value of ETH in 5 years?

At the time of writing the article, the ETH price is $3,829.90. Ethereum price prediction gives targets up to $64,154 by 2029.

Is Ethereum a buy or sell?

According to TradingView at the time of writing, Ethereum’s technical indicators suggest that it is a buy on a daily scale and a strong buy on weekly and monthly scales.

Disclaimer

This article is not a piece of financial or investment advice. No price predictions are guaranteed to provide exact information on the future price. When dealing with cryptocurrencies, remember that they are extremely volatile and thus, a high-risk investment. Always make sure to stay informed and be aware of those risks. Consider investing in cryptocurrencies only after careful consideration and analysis and at your own risk.