Many DeFi staples originated in MakerDAO protocol: take governance tokens and algorithmic stablecoins. In our MKR guide, we’re going to explain the Maker protocol and answer what makes Maker stand out.

What is MakerDAO?

At the very core of new economic systems envisioned by cryptocurrencies are the values of decentralization and accessibility. Bitcoin sprang from frustration caused by the outdated centralized financial system, as the message embedded into its genesis (the very first) block references the Fed bailout for the banks in the financial crisis of 2008.

BTC managed to establish a market around it, but did not become an effective means of value transfer due to its volatility. That’s when stablecoins entered the scene. However, most stablecoins that found a significant degree of adoption, like Tether, lacked decentralization.

MakerDAO exists to solve these problems: it is an open-source project on the Ethereum blockchain and a Decentralized Autonomous Organization with the same name. It was created in 2014 with the goal to bring an economic ecosystem powered by a currency that would be truly decentralized and stable.

MakerDAO Timeline and Team

MakerDAO’s history starts in 2014, and in 2015 its global team of developers began building the ecosystem. In December 2017, they published the first whitepaper, introducing the Sai (then Dai) Stablecoin System.

In this iteration of the project, the full name of Dai was Single-Collateral Dai (SCD), because the system accepted only ETH as a collateral. Using ETH in this way, any participant could generate SCD through a complex system of smart contracts.

The initial iteration of the system included the foundation for the multi-collateral system that exists now. In November 2019, the whole system was updated to the current Maker protocol that is powered by DAI.

The Maker Foundation built and launched MakerDAO. Now they are but a part of the global community and do not have exclusive governance rights over the protocol anymore.

The board of Maker Foundation includes Rune Christensen, CEO and founder, Steven Becker, COO and President, and Andy Milenius, CTO. The Dai Foundation, based in Copenhagen, Denmark manages trademarks and code copyrights.

How does MakerDAO work?

In short, MakerDAO offers lending in the stablecoin called Dai. By depositing a supported Ethereum token into a Maker Vault, a user generates a loan represented in DAI, which starts accruing interest. Upon reclaiming the deposited assets, they repay the Vault in the borrowed sum with the accrued fees.

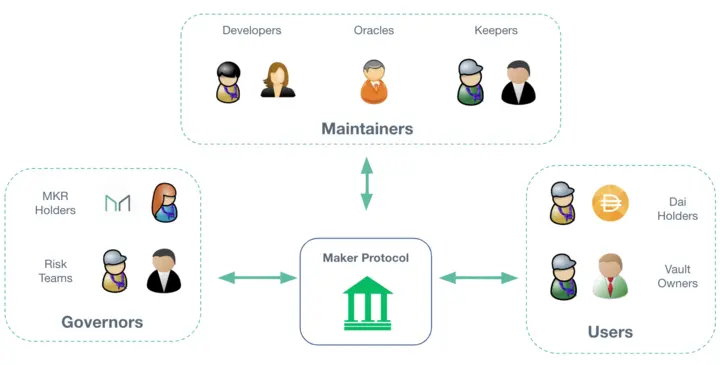

Users represent Dai holders that generate DAI via Maker Vaults. Governors are the participants that have an extensive knowledge of the Maker protocol and help in making key decisions. Maintainers are the businesses and other participants that use the Maker protocol in their platforms or products, as well as keepers who help maintain the Dai peg, and decentralized oracle structure governed by MKR holders.

What is MKR?

Maker (MKR) is a governance token in the MakerDAO system. It represents the voting power of a network participant and entitles them to participate in making decisions that will affect the network. Anyone can submit an improvement proposal, but it’s the MKR token holders who get to vote.

In addition,** recapitalization of the protocol** also uses MKR and if debt exceeds the surplus, MKR is auctioned off. This is how it helps maintain the stable peg of Dai. Therefore, it is in the interest of MKR and DAI holders to govern the protocol in a way that will not hurt their MKR holdings.

Anyone can purchase the voting rights in the form of the Maker tokens on an open market. Keep reading to learn how.

What is Dai?

DAI is a stablecoin with a soft peg to US Dollar. In simpler terms, its price is always roughly equal to $1, but its value is not backed by the US Dollar itself.

In DAI’s case, the cryptocurrencies locked into the Maker protocol as the collateral back Dai’s value up. The smart contracts can mint more MKR tokens or burn them to keep the value of Dai stable.

The currencies in the Vault over-collateralize the “debt” represented by the DAI total supply. Think of it like a mortgage: the bank provides a loan in return for ownership rights, and to reclaim the ownership, a taker has to repay the debt and fee.

Comparison with Similar Projects: Aave and Compound

The Maker Protocol earned significant adoption as one of the first decentralized finance (DeFi) applications. For the longest time, Maker has had the most assets locked in it according to the DeFi Pulse analytical service.

If we compare the Maker system to other largest lending protocols, Aave and Compound, we can see that:

- In Maker, users can only generate Dai to borrow. In Compound users borrow tokens from its 9 markets, in Aave — 20;

- Collateral portfolio is different across all platforms. Aave supports 20 tokens, Compound — 9, Maker — 12;

- Dai Savings Rate smart contract lets users generate DAI interest on tokens locked into the contract through stability fees. In Compound and Aave the liquidity supply generates the interest;

- Neither Aave nor Compound have their own stablecoins.

How to use MKR?

The whitepaper describes possible uses for the Maker protocol as following:

- Issuance and maintenance of the Dai stablecoin. Borrowed Dai can be used as digital dollar;

- Asset expansion: it is quite possible that the community will be able to use the Maker system to issue alternative assets similar to Dai;

- Decentralized oracle network akin to Chainlink.

The primary use case for MKR token itself is to influence these broad development directions. To pay the outstanding stability fee on a Dai debt closing, along with Dai itself users can opt for MKR.

Is MakerDAO Controversial?

The overly complex architecture and economic model of MakerDAO and DAI received criticism in the past. The Maker token specifically, its value is entirely dependent on the Maker system, but the stability of a decentralized lending system and stablecoin were doubted by some industry experts more than once.

In fact, in 2020, the MKR news reported that Maker and DAI holders were considering an emergency shutdown in the face of a $4 million debt. It arose as a result of a technical error which coincided with a period of Ethereum network congestion and a sudden crash of the market prices. The community had to hold an emergency vote on a variety of changes to the protocol to help the project stay afloat.

Future plans of Maker

Governance will decide on a ton of stuff ranging from day-to-day management of the system to key decisions on larger upgrades or system changes if they are needed. The governance of the Maker system is now set up in such a way that MakerDAO basically runs itself. In the long run, this should drive the demand for MKR tokens as well.

The active Maker Improvement Proposals are discussed on the MakerDAO forum. Among the most discussed are onboarding of Keep3r Network as a collateral, improved proposal process and distributing tasks among teams. Most of these are aimed at both ensuring sustainability of the protocol in the long run and realizing its potential.

MakerDAO on Twitter

Let’s have a look at what the Twitter users discuss at the time of writing this Maker coin guide.

The Maker Governance has voted to add rETH (@Rocket_Pool staked ETH) as a new collateral type in the Maker Protocol.

— Maker (@MakerDAO) June 16, 2022

Voting results:

• 40,858 MKR voted YES (winning option)

• 22,163 MKR voted NO.

• 0.22 MKR voted ABSTAIN.

🗳 https://t.co/tBuFUuL2dS pic.twitter.com/cZGLRG6rk2

Just a snippet of a day in the MakerDAO: the community voted to add a new type of collateral, rETH.

Lets talk about something intrinsically valuable in crypto during this shit storm. $MKR has always been on my list of diligent builders in the crypto landscape. They were holding phenomenally well during the last bear market. And more…

— will (@181_will) June 15, 2022

User will wrote a whole thread outlining a bullish case for the MKR token.

⚡️Total Value Locked #TVL in #Ethereum Ecosystem

— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) June 17, 2022

17 June 2022#ETH $ETH $MKR $LDO $CRV $UNI $AAVE $CVX $COMP $INST $BAL pic.twitter.com/wTlRFniquz

Even in 2022, Maker remains at the top of the Ethereum ecosystem. Its total value locked is almost twice the TVL of a runner-up, Lido.

How to store MKR?

Maker (MKR) and Dai are ERC-20 tokens, so a range of the wallets in which it can be stored is rather wide. We have a couple of recommendations for you:

- Hardware wallet — Trezor;

- Software — Exodus, available on desktop and mobile.

With these wallets you will never have to worry about how to exchange MKR again: their interfaces have built-in crypto-to-crypto exchange functionality. Just exchange some of your crypto on the go in these wallets using ChangeHero!

How to exchange MKR?

Puzzled how to exchange MKR on ChangeHero? Here is the Maker coin guide that can help you:

- Choose the currencies on the home page, amounts and the type of exchange (Best or Fixed rate). Provide your MKR wallet address in the next step and adjust the transaction details if needed;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send in a single transaction your crypto assets for the exchange. For Fixed Rate transactions you have 15 minutes before it expires;

- Sit back and relax. From now on we will be handling everything: checking the incoming transaction and doing the exchange as soon as it arrives;

- As soon as the exchange has been processed, your MKR is on the way to your wallet.

If you ever run into any issues during your swap, our support specialists are always available to help you out in the chat or through the email: [email protected].

Conclusion

MakerDAO is simultaneously a pioneer in DeFi and a trailblazer for all new projects centered around decentralized finance. Through ups and downs, it still provides enough value to amass millions of dollars locked in the protocol.

Hope you enjoyed this MKR guide by our team! Let us know in social media or the comments of our blog and subscribe: we’re on Twitter, Facebook and Telegram.