The problem of scaling Ethereum almost seems to be evergreen. The demand is as high as ever, and the solutions are no longer scarce in number. In this beginner-friendly guide, we review one of the leading layer-two solutions — Optimism. How does it work? What’s in the name? Does it have a token? What for? Find all the answers below!

Key Takeaways

- Optimism is a layer-two scaling solution for Ethereum. It relies on the main chain for arbitration but handles transaction processing itself, much faster and cheaper than layer one;

- The main technology called optimistic rollups batches transactions and posts them as is in a Merkle tree to Ethereum. It greatly increases the speed and throughput of transaction processing at the cost of a long withdrawal period;

- Using Optimism requires you to bridge ETH or ERC tokens first because technically it is a separate blockchain from Ethereum. To develop the Optimism ecosystem, the Optimism Collective has complex systems of governance and funding that use the OP token.

What is Optimism?

Optimism is a layer-two solution for Ethereum that provides faster and cheaper transacting with the help of rollups. Since it’s a layer-2, it means the network is an extension to Ethereum to help transfer ETH and ERC tokens. The project’s tagline is, “Optimism is Ethereum, scaled”.

Ethereum’s current throughput is around 15 transactions per second. At the same time, it hosts a huge ecosystem of decentralized finance (DeFi), Web3, and gaming projects. Most of them utilize both regular and non-fungible tokens (NFT). High demand and the fee structure that prioritizes higher tips make it costly to use for some users. It goes against the ideas and narratives about crypto helping all people take finance into their own hands. This is why layer-2 (or L2 for short) scaling solutions for Ethereum came to be and are so popular.

How Does Optimism Work?

Optimism uses optimistic rollups to batch a lot of transactions together and process them at a fraction of the original cost. The more this network is used, the cheaper the transactions, since the costs are split within the batch. This is achieved thanks to Merkle trees, a data structure often used in cryptography. It can compress multiple objects signified by individual hashes in a single data block. Other nodes in the network can verify and calculate the “leaves” with the hash of the “root”.

Another step toward accelerating the processing of transactions is a separate set of block producers. Optimism’s block producers take the computational load off the Ethereum nodes. This way, the L2 transactions do not need to share block space with L1.

Optimistic Rollups

Rollups come in several flavors, “optimistic” being only one of them. The name comes from the “optimistic assumption”, a principle in which only the final result is checked upon settlement. It helps to make latency as low as possible at the cost of long challenge periods on settlement and withdrawal. Another upside to this assumption is that complex transactions and even smart contracts can be processed on such an L2.

Any kind of rollup requires you to use a bridge first. To avail of the benefits they offer, you will need to transfer your assets from Ethereum to Optimism. It takes no longer than a regular transaction, and the assets on L2 will be available right away. You can withdraw them back any time but only after a fault challenge period. The withdrawal completes successfully provided the validators find no fault proofs within seven days.

The Optimism Ecosystem

Essentially, Optimism’s blockchain is separate from Ethereum. As a result, interacting with dApps in the Ethereum ecosystem directly is not possible. What is possible is to use the applications and products built on Optimism itself. Many of them include those that have their versions on both L1 and L2: Synthetix, Aave V3, Uniswap V3, Beefy Finance, and Curve. Some Optimism originals include

- a decentralized exchange Velodrome;

- a fork of the Compound lending protocol Sonne Finance;

- a perpetual swap exchange Pika Protocol.

Optimism’s Team and History

The first use of the term “optimistic rollups” can be attributed to Karl Floersch of the Plasma group. In 2018, he specified how this kind of rollup can work with Plasma and Optimistic Virtual Machine (OVM). The group was coming up with ways to scale Ethereum natively but by the end of 2020, they disbanded. Or rather, reformed as a public benefit corporation (PBC) Optimism as the research phase shifted to production.

By early 2021, the team was eager to launch Optimistic Ethereum as the crypto space was only heating up. However, in March 2021, the full mainnet release was postponed. The launch for whitelisted participants opened in August, and by December 2021, Optimism — a new, simplified name — became publicly available.

In 2021 alone, the Optimism PBC and its flagship project received significant funding from crypto-focused VCs and investors. The $25M Round A leaders were a16z and Paradigm and the Round B netted the team $150 million more.

In 2022, the team has initiated yet another step toward their vision by reforming Optimism PBC into OP Labs PBC. Key decision-making was no longer in its scope of operations. The governance was entrusted to the Optimism Collective with Optimism Foundation as its legal entity representative.

Optimism’s Native Token OP

Not every scaling solution has a crypto token of its own but Optimism does. It uses the ticker OP and its primary use case is decentralized governance.

The Optimism team’s mission is to build public goods without compromising on profits. Public goods in this case are Ethereum-based applications, projects, and products for Web3 and DeFi. In an open-source model, according to the manifesto, the incentives are not always aligned with the impact on society.

The Optimism Collective is an experimental decentralized autonomous organization (DAO) that handles governance and funding. One part of it, called Citizen House, is responsible for retroactive public goods funding (RPGF). It is essentially a prediction market to help projects on Optimism get funding as if they were startups. The other, Token House, makes decisions on things like treasury allocation and grants, inflation rate, and upgrades.

OP Distribution and Tokenomics

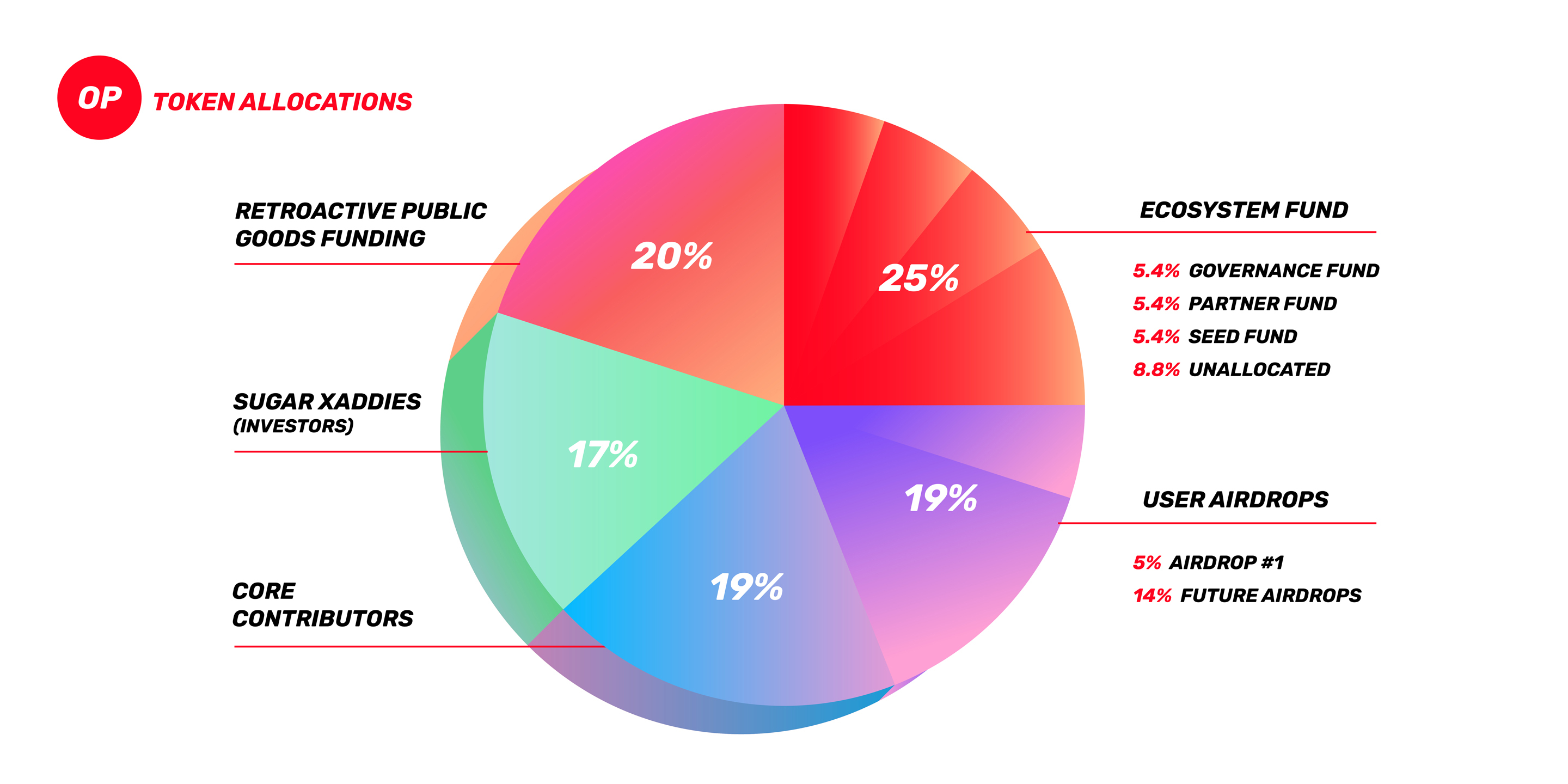

The Token House was established with the first airdrop of OP tokens in March 2022. The Foundation distributed them to Optimism users and a set of L1 users that met their criteria. Out of 200M OP to be airdropped, 165,577,729 OP, which is 77% of the total sum, were claimed. The second airdrop happened in February 2023. It rewarded users who voted or delegated their OP and those who spent a certain amount on gas fees.

The past and future airdrops to users will distribute 19% of the total supply of OP. 25% is set aside for the Ecosystem fund, a temporary incentives program due to be eventually fully replaced by RPGF. 20% more is allocated to it from the very start. Core contributors and investors also get their shares, 19% and 17% respectively, that are subject to lockups.

How Do You Use OP?

As a utility token, OP’s main use case is a representation of voting power. Holders can either vote themselves or delegate to someone else without giving up custody over the funds. The only exception to this is the OP tokens that have been staked or locked in a liquidity pool. There is no minimum threshold for OP to vote.

The OP token has been designed to accrue value for token holders, contributors, and community members. Through a cycle of block space offering, revenue generation, and RPGF, OP will create value for all three constituencies. In this context, OP can be viewed as a vehicle to invest in Optimism.

Optimism And Similar Projects

Optimism vs. Arbitrum

The most direct competitor of Optimism is Arbitrum. Both scaling solutions use optimistic rollups and have native tokens with similar purposes. In comparison to the multi-layered governance structure of Optimism, Arbitrum has just started its path to decentralization. Until recently it had neither a token (ARB) nor a DAO.

The initial development of Arbitrum and Optimism was happening around the same time. Both networks were ready to deploy mainnets by August 2021. Despite having the first-mover advantage, Optimism has not amassed the same total value locked as Arbitrum:

Despite having a lower TVL, Optimism outdoes Arbitrum in transaction volume.

Is Optimism Controversial?

The design of optimistic rollups implies certain tradeoffs to achieve lower latency and cheaper fees. As we have already mentioned, the challenge period for withdrawal is a whole week. This is not entirely intentional, as the smart contracts necessary for this process reside on L1 — Ethereum. Moreover, rollups have to rely on the data availability of L1 as well. No matter how many transactions get processed on the side, the L2 state is posted to Ethereum every hour or so.

Optimism developers have a history of delays in shipping releases and upgrades even after the mainnet release. The upcoming July 2023 upgrade Bedrock was initially due in late March to early April 2023. The official messaging about these delays claims they were necessary to deliver a better product and experience. However, the pivot away from open source to a for-profit approach was supposed to solve this problem.

Last but not least, the tokenomics of Optimism (OP) put it in a vulnerable spot when it comes to securities laws. Due to its promise to generate value, it can fall under the category of an investment contract. In many countries, financial instruments have to go through registration with a responsible government body due to consumer protection concerns. The Foundation is registered in the Cayman Islands but to work with the US customers, they need registration in the US regardless.

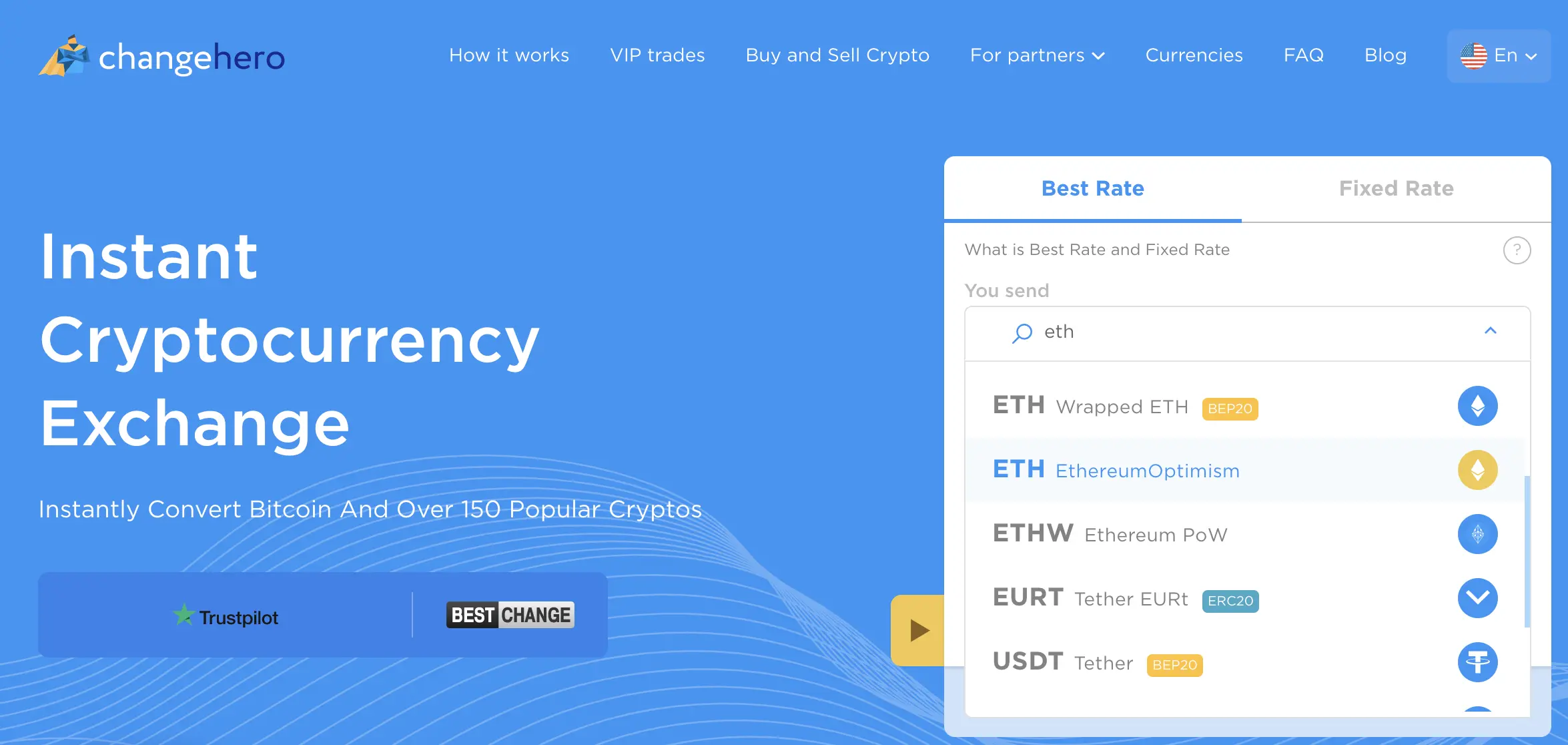

Ethereum on Optimism Now Available On ChangeHero!

The best way to see how Optimism makes trading Ethereum fast and cheap is to try it yourself. No matter if you want your ETH on Optimism swapped or received, ChangeHero provides instant crypto swaps of both kinds. Time (and gas) is of the essence — swap Ether through Optimism on ChangeHero today.

Can I Buy Optimism (OP)?

Yes! If you want to buy or sell OP with crypto, follow these easy steps:

- Choose the currencies on the home page, amounts, and the type of exchange. Provide your OP wallet address in the next step and check the details;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send the cryptocurrency for the swap in a single transaction. In a Fixed Rate transaction, you have 15 minutes before it expires;

- Sit back and relax. Now we are doing all the work: checking the incoming transaction and making the exchange as soon as it arrives;

- As soon as the exchange has been processed, your OP is on its way to your wallet. And so, the transaction is finished!

If you ever run into any issues during your swap, our support team is available 24/7 to help you in the chat or through the email: [email protected].

Conclusion

These days, there is no lack of solutions that help with Ethereum’s gas fees or slow processing speed. Optimism launched when the competition was at its fiercest but still emerged as one of the industry leaders. Seeing that the demand for Optimism is rising, even out of the bull market it thrives and keeps innovating the space.

Did you find our guide helpful? Let us know on Twitter, Facebook, Reddit, and Telegram. Subscribe to ChangeHero on the social media of your choice for daily updates and even more content. If you feel like deepening your knowledge about crypto, check out the ChangeHero blog.