The bull run that started in 2020 was fueled in part by institutional investors who gained unprecedented exposure to the market. However, they are using a more sophisticated approach than retail traders. What are crypto CFDs and ETFs, how do they work and why do they matter? Find the answers to these questions in our new article.

What are Crypto CFDs?

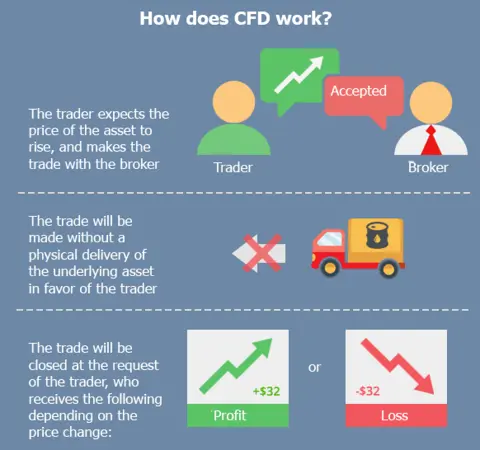

Before delving into the question “what are crypto CFDs”, it’s useful to get to know or refresh what a CFD is. CFD stands for “contract for differences”, and it is a type of derivatives trading. With CFD, an arrangement is made to pay the difference between the price at the time of agreement and current price in cash.

Essentially, traders make bets whether the price of an underlying asset will rise or fall. If they believe the price will go up, they open a buy position, and vice versa. What are crypto CFDs? These are contracts to trade cryptocurrencies as an asset participating in the CFD. In this case, crypto CFD meaning would be betting on a movement of a crypto/crypto or crypto/fiat pair.

How does Crypto CFD work?

How would a crypto CFD work? Let’s say, Alice wants to buy a CFD on BTC. Bob, who is a broker, requires 5% of the trade for his services. Alice buys a representation of BTC for $50,000 per share for a $25,000 position. Out of it, 5% or $1,250 is paid initially to Bob. A month later BTC is trading at $75,000, and Alice exits the position with a profit of $18,750 in total. The CDF is cash-settled, the initial position of $25,000 and the closing position of $37,500 are netted out. The gain of $18,750 is credited to Alice.

Where to Trade Crypto CFDs?

Crypto CFDs can be traded on the majority of OTC desks that have the option to trade cryptocurrencies. It is very likely that there is one available in your region: Markets.com, XTB, eToro, Plus500, AvaTrade, CMC Markets and others.

Crypto CFD Advantages and disadvantages

What are crypto CFDs good for and what to be wary of?

Crypto CFD Pros

- Access to the underlying asset for only a fraction of the price. You do not need to buy an asset outright but get the full profit (or loss) from your position.

- Moreover, in a CFD you do not actually have to buy cryptocurrency at all. No problems with exchanges, transfers and keeping the digital coins.

- Flexibility. With CFDs traders can go both long and short, while it is not always possible with spot trading.

Crypto CFD Cons

- In volatile markets, a difference between bid and ask price will be higher, which will lead to less profit because brokers require higher fees.

- Not actually owning a cryptocurrency can also be seen as a minus. Holding strategy won’t work here, as CDFs are only suitable for trading.

- Not all pairs and coins are supported by brokers.

What are Crypto ETFs?

An ETF, which stands for “exchange traded fund”, is a derivative asset which tracks a selection of assets but can be traded like an independent asset. For example, SPDR S&P 500 (SPY) is an ETF which tracks the S&P 500 index (index of top-500 exchange-traded American companies). An index itself is only a metric but with a derivative like an ETF, it can be traded on an exchange. ETF is usually a basket of assets that is managed by an authorized provider (AP). In the case with cryptocurrencies, APs take care of custody and managing digital assets.

What are the Bitcoin ETFs?

Those are investment vehicles that mimic the price movements of Bitcoin. This kind of trading Bitcoin can be more approachable to institutional investors.

Is there an ETF for Cryptocurrency?

There are only a few of them at the moment as the regulators are somewhat reluctant to approve digital asset-based ETFs. Most of them are Bitcoin- or Ethereum-based. Among the countries that approved them are Canada and Brazil, and the USA’s Security and Exchange Commission is considering several Bitcoin ETFs.

Crypto ETF Advantages and Disadvantages

Crypto ETF Pros

- The main purpose of crypto ETFs is to trade on an unregulated market in a regulated manner. The authorized provider is supposed to handle all the risks.

- Crypto ETF allows traders to short sell, which is near impossible with an actual asset on hands.

Crypto ETF Cons

- Lower liquidity in comparison to spot trading

- Authorized providers require fees for managing the underlying asset

- Requires authorized participants means the selection of brokers is limited

Differences between Crypto CFD and ETF

What are crypto CFDs differences from an ETF? It should be obvious by now but wouldn’t be wrong to reiterate. In fact, these two are completely different things: an ETF is a derivative and a CDF is a contract. CFDs can actually be used to trade ETFs! An ETF also has to be approved by a regulator while CFD trading is done on an OTC basis by many brokers.

What do CFDs and ETFs mean to crypto?

What are crypto CFDs and ETFs doing for the crypto space? It’s a bit complicated. On the one hand, being included in exchange-traded products and contracts gives legitimacy to digital currencies. These derivatives are more closely regulated and give exposure to assets to investors who don’t want to handle risks themselves. On the other hand, treating digital currencies like assets to back derivatives leads to commodification. Bitcoin was meant to be owned and used for transactions. Now it has become an asset class which is lauded for the ability to accumulate value due to its immutable scarcity.

Conclusion

It seems that in the 2020s cryptocurrencies are about to be adopted not only for retail and everyday transactions but also as assets for trading. All kinds of crypto derivatives are getting recognized, and that could also be viewed as a facet of adoption. So what are crypto CFDs and ETFs? Now you know! Want to know more? Then read more articles from our blog. For content on the go, sign up for our updates in Twitter, Reddit, Facebook and Telegram.