News headlines are more often overtaken by stories of non-fungible tokens selling for hundreds of thousand dollars. What are NFTs and why are people saying it is one of the most promising blockchain technologies? NFTs explained by the ChangeHero team in this guide in depth.

Key Takeaways

- NFT stands for non-fungible token, a unique asset on a blockchain that cannot be used interchangeably with other tokens;

- The uniqueness of the NFT standards makes them a boon for demarking ownership and/or rights to use. This is finding use in art and distribution, blockchain services and games;

- The most popular NFT platforms and projects these days are Crypto Punks, Bored Ape Yacht Club.

What are NFTs?

First of all, let’s sort through the term: what is a non-fungible token? What does non-fungibility mean? Fungibility is a property of an asset that means it is interchangeable with any other asset of the same value. On the contrary, non-fungibility is synonymous with uniqueness. Even if two non-fungible tokens have the same value (for example, represent the same in-game item), they are not interchangeable. How can this be useful? Like in the example above, NFTs can represent in-game assets like items, cards or pieces of art. Each token represents a unique unit of value, even if they belong to the same category. Basically, non-interchangeability is useful to determine ownership of an asset that NFT represents.

How Did We Arrive at NFTs?

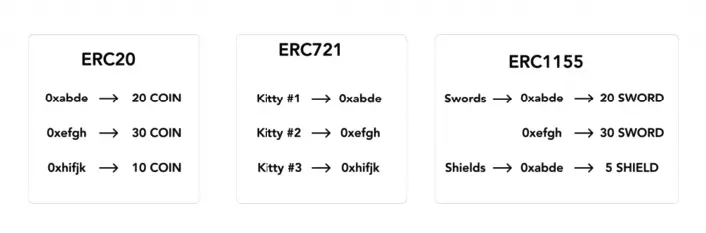

The first tokens were actually developed for the Bitcoin blockchain and were essentially non-fungible. They were called Colored coins and are considered predecessors of modern blockchain tokens. Another second-layer network to Bitcoin, Counterparty housed the first tokenized directory for Rare Pepes. Each of the entries in the library is unique and represented by its own Counterparty token. Then, in 2015 Ethereum introduced smart contracts. Now, everyone could issue and transact with tokens even more easily. The only catch is that back in 2015 there was only one token standard — ERC-20. Nevertheless, Decentraland, CryptoKitties, CryptoPunks and EnjinCoin started implementing tokenized assets in games and digital art. It was after the success of these projects that the ERC-721 standard was developed in 2018.

How Do They Work?

NFTs are not exclusive to Ethereum: among the platforms that support them are Ravencoin, Qtum, EOS, TRON… In essence, though, they are the same. Each token is assigned a digital hash that distinguishes it from every other NFT of its kind. NFTs cannot be directly exchanged with one another because of their unique nature. Instead, they can be put on sale on special marketplaces for a cryptocurrency of choice.

What are NFTs’ other properties?

- Non-interoperability: a nonfungible token cannot represent different assets in different games or apps;

- Indivisibility: there can be no more than a set number and no less than one of an NFT;

- Indestructibility: the data is immutably recorded on the blockchain;

- Verifiable: like any asset on blockchain, an NFT can be traced back to its original creator.

NFT Standards: Non-Fungible and Semi-Fungible

In the case of Ethereum, there are now two standards which can be used for NFTs. ERC-721 is strictly non-fungible and unique. ERC-1155 is semi-fungible, and allows for class tracking rather than object tracking. For example, in a game ERC-1155 tokens can be used to represent consumable items like ammo or potions. This standard is also handy because it saves computing power of the network, and therefore, transaction fees.

What are NFTs Used For?

NFTs became a huge step in tokenization of various assets on blockchain. Here are only a few examples how they can be used:

- Authenticity check. CryptoKicks are a patented product of Nike. These are tokens that are sold together with the shoes and are used to verify authenticity of the product;

- Collectibles. Sports cards and other collectibles are pretty much the real life equivalent of a classic NFT. Football clubs like Juventus collaborate with blockchain developers such as Sorare to issue player cards. Fans can buy them to show support to the club and put them to use in the Sorare’s fantasy soccer game;

- Ownership. Another use case where NFTs can see a lot of potential is music distribution. For example, musician DJ 3LAU offered his latest album for auction as an NFT. The winners can redeem their tokens for vinyls, custom tracks and streaming subscription. This scenario cuts out middlemen such as distributors, who claim large shares of musicians’ profits.

- Name services like Unstoppable Domains or ENS (Ethereum Name Service) use the NFT standard to create unique human readable addresses for ETH.

Why are NFTs so Expensive?

According to Nonfungible.com, an average NFT sale in September 2021 brought a seller $6,132.62. The top most expensive NFTs heavily skew the estimate: these went off the auction for nearly $6 million. But why are people so willing to spend millions of dollars on a token with a link to a JPG or a PNG? The logic is the same as with pieces of art: the bids are made exclusively with the perceived value of an asset in mind. If an NFT is associated with a famous personality or project, it can be sold for millions of dollars. It does not have to be something of incredible artistic value: Crypto Punks are randomly generated simplistic pixel art avatars. In less known projects, such as Blockchain Art Exchange NFTs were sold for $25 on average, and CryptoZombies went for $1.3 on average. NFTs are far from being a rich-only club, as there are many projects that a regular enthusiast can get into.

Ten Most Expensive NFTs

That being said, auctions which see NFTs being sold for astronomical prices are the main drive of the interest to the market. Just to give you an idea what is popular with the enthusiasts and why, here are some of the most expensive NFTs ever sold:

- Beeple, Everydays: The First 5000 Days: a collage of 5,000 pieces made by the digital artist. $69,346,250.

- Edward Snowden, Stay Free: the whistleblower’s portrait with the court ruling finding surveillance brought to light by him, illegal. $6,886,126.72;

- CryptoPunk #8857: Zombie, Wild Hair, 3D glasses. $6,641,920;

- Beeple, Crossroads: a surprise auction, which was bought out for ten times the original price upon revealing. $6,600,000;

- Beeple, Ocean Front: a piece from the Everydays series now owned by Justin Sun. $6 million.

- Dmitri Cherniak, Ringers #879: procedurally generated Art Blocks picture, initially sold for $129.37. $5,698,249.57;

- CryptoPunk #6275: Zombie, Mohawk Dark, Shadow Beard. $5,142,530.39;

- Mad Dog Jones, Replicator: an art NFT that produces copies of itself. $4,144,000;

- Bored Ape #3749: Bored Ape Yacht Club generated avatar with laser eyes and solid gold fur. $2,921,076;

- CryptoPunk #8888. The number of the entry is probably the reason for reselling so expensively: $2,872,435.92;

Businesses and Celebrities

Seeing just how much the tokens can be traded for, plenty of businesses decided to join the trend. Just a few of them are:

- Heavy Metal, legendary comics magazine tracing its history from the 70s. They released a collection of NFTs with classic covers, as well as entries that can be fused into the rarest kind in the collection;

- Naomi Osaka, Japanese-Haitian tennis star. The April collection included six artworks inspired by the athlete’s career and experiences;

- Caretaker of Kabosu, poster dog(e) of the Doge meme, Sato Atsuko auctioned off the NFT with the original photo for 1,696.90 ETH;

- Fox Corporation, American media giant, struck several collaborations to launch a blockchain-based media distribution platform;

- Alibaba Auction, an arm of the Chinese e-commerce giant, has a dedicated section for NFTs explicitly for copyright purposes.

What are NFTs Criticized For?

As any emerging technology and market, NFT trading is rife with things that haven’t been worked out yet. In fact, there are so many problems in the space that at the current state it is almost controversial.

Intellectual Property Rights Abuse

The most glaring problem is that while NFTs are handy to represent ownership, from a legal standpoint they do not yet. Unless explicitly stated in the process of sale (and that is how large auctions operate), the creator of an artwork retains all rights to use the original artwork. Moreover, at the peak of the NFT boom, art theft was rampant, when users would mint NFTs of artworks without an original creator not even knowing about it. While NFTs were supposed to let creatives monetize their art without any middlemen, the opposite was happening: middlemen hijacked the art monetization. Independent artists have to deal with the intellectual property rights abuse themselves but at least they have a choice how to engage with the NFT market. Meanwhile, media giants such as Marvel and DC preemptively bar their contractors from using the characters for NFT sales. In all cases, though, since legally NFTs are worth only as much as the contract implies, the linked content can be taken down. This is far from pleasant to both sides, since creators have to deal with copyright issues and the owner of an NFT ends up with worthless junk code.

Market Manipulation

The NFT market inherited both best and worst practices from its art auction predecessors. Particularly, wash trading which is repeated and coordinated buying and selling to artificially inflate the volume of an asset. In a study of the Nonfungible.com team, between May 2020 and February 2021, an unnamed marketplace had as much as 28% ($2,252,925.00) volume accounted for by wash trading. 10% more was defined as suspicious. Anecdotal evidence also points to insider trading making its way into the industry. OpenSea product lead was accused of trading a drop before it going public, and resigned on the accusations.

Buying Into FOMO

And finally, while some collections were making headlines and auctioning for hefty sums, the price floors for the rest of the market fell significantly. Only 26.9% of the OpenSea sales are liquid, and the most actively traded 3% account for 97% of the dollar volume. Even being a celebrity is not a guarantee to get into the 3% of high-profile projects. Wrestler and actor John Cena managed to sell only 7.4% of his collection of NFTs. All these points of contempt are more than just kinks and quirks to work out. Engaging with the NFT space can be highly rewarding but requires an incredible degree of due diligence for success.

How to Create NFTs?

Good news: making an NFT is not rocket science! Anyone can mint and even put up for an auction an NFT with any content they rightfully can. To get your hands on an NFT, you can attach something of value to a new unique nonfungible token. Many platforms have generators that streamline the process of creating NFTs. Some of the apps that let you make an ERC-721 token are MetaMask, Mintable, and Receiptchain. The best shot for creating an NFT on another blockchain would be through an official dApp or wallet.

Where to Buy and Sell NFTs?

Another option to get an NFT for yourself is to hunt for gems that other people have already created. As mentioned, NFTs can only be traded on special marketplaces, as they are not directly interchangeable. What are NFTs marketplaces? The most popular ones are OpenSea, Rarible, Super Rare, Axie Infinity and Nifty. Some projects have their own dedicated marketplaces, such as CryptoPunks and NBA Topshot.

In Conclusion

All in all, what are NFTs’ merits and prospects? Anything, from digital identity to a work of art can be put on blockchain, which guarantees uniqueness and verifiability. This versatility of actual use cases is the reason NFTs are said to become the next big thing. Did you know that NFTs are often featured in crypto news and Beginner’s Guides? You can read more of them in our blog. If you want to get the updates to it first, follow ChangeHero on social media: Twitter, Facebook, Reddit and Telegram.

Frequently Asked Questions

How to create an NFT?

NFTs can be minted like regular tokens, with the help of special services or wallets, even without technical expertise. Such services include MetaMask, Mintable and Receiptchain.

What is an NFT?

NFT stands for “non-fungible token” which is a kind of blockchain asset that is irreplaceable by its analogs. Each NFT associated with a single contract is unique.

What are NFTs used for?

NFTs are finding use in art distribution, certificates of authenticity, digital copyright certificates and most commonly, collectibles.

Where to buy NFTs?

There are plenty of dedicated NFT marketplaces: OpenSea, Rarible, Superare and so on. Blockchains other than Ethereum have different marketplaces.

Will NFTs be the future?

Provided there is more certainty to their use and maybe even legal precedence, NFTs can fulfill the purpose of the certificate of originality they blew up on.

What are some examples of non-fungible tokens?

Common examples of non-fungible tokens would be randomly generated CryptoPunks or NBA TopShot athlete and club collectibles. A less obvious but very illustrative example would be Unstoppable Domains, which is a human-readable Ethereum address service.