DeFi, play-to-earn games and NFTs, oh my! — Solana has it all and claims to scale to breakneck speeds. In this Solana beginner’s guide, the ChangeHero team will introduce and explain what Solana and the Solana’s native cryptocurrency SOL are.

Key Takeaways

- Solana is a decentralized protocol for distributed computing and building dApps. Its main advantage is the ability to scale up to 65,000 transactions per second;

- Solana protocol combined original Proof-of-History protocol with the Proof-of-Stake consensus algorithm which makes it faster and more energy efficient;

- The Solana platform is backed by major market players like Circle and Tether. DApps with smart contracts built on it already have millions of active users.

What is Solana?

At its core, the value proposition of Solana is not very different from Ethereum’s. It is a public base-layer blockchain protocol that is best suited for decentralized computing and creating decentralized applications (dApps).

What is Solana’s improving, then? By design, this protocol is near-perfectly **optimized for scalability. **

As a result, dApp devs do not need to design around performance bottlenecks. This is achieved with an innovative hybrid consensus model combining a Proof-of-Stake (PoS) consensus algorithm with a novel Proof-of-History (PoH) timestamp system.

Proof-of-History

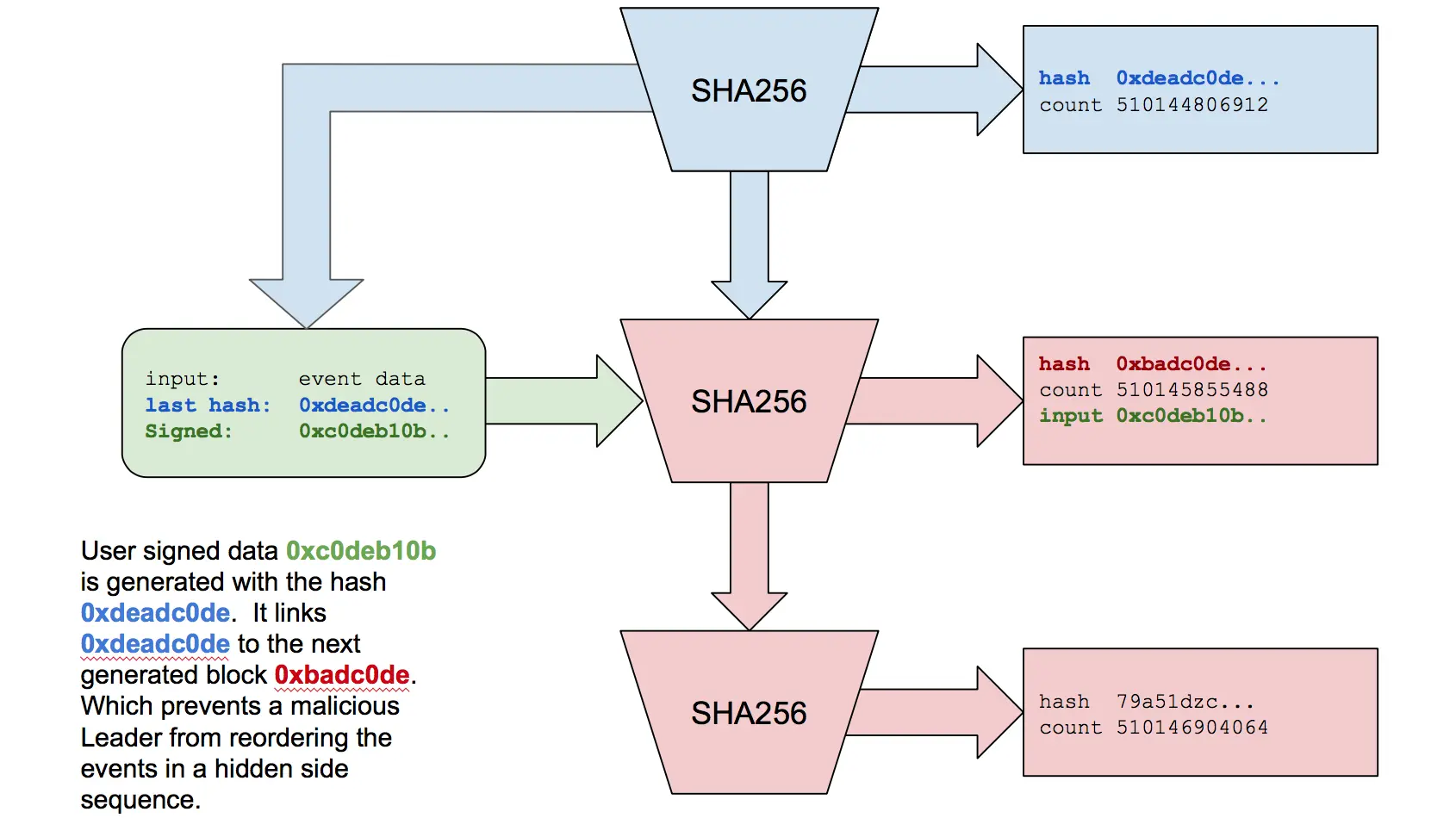

Solana hashes all transactions with the SHA-256 algorithm (the same that Bitcoin uses). An output of each transaction is the input for the next one, and since hashing takes a set amount of time, it is used instead of timestamps.

The problem with the timestamps in blockchains like Bitcoin is that every miner uses local time or even inaccurate time. To avoid reorganization, Solana blockchain uses hashes that link the blocks in a cryptographically verified succession.

In a very short amount of time, every 400 ms, validators vote on inclusion of transactions in slots. Each subsequent vote doubles the amount of time needed to roll the consensus back.

PoH relies on Proof-of-Stake (in Solana’s blockchain, the Tower BFT algorithm) to validate transactions. To pass it, at least two thirds of all nodes have to agree with each other. PoH is more like an additional securing mechanism which prevents rollbacks.

History and Team behind Solana

In 2017, Qualcomm engineer Anatoly Yakovenko published the Proof-of-History whitepaper. With his colleagues, Greg Fitzgerald and Stephen Akridge, they built a prototype testnet in 2018 and founded Solana Labs.

The team was joined by Raj Gokal, who is now the company’s COO. Through 2018 to 2019, the team was fundraising and building the protocol in parallel.

By March 2020, Solana Labs was ready to launch the Solana blockchain, shortly after a token auction which raised $2.4 million.

Solana Labs, which is still the major contributor to the development, itself is based in San Francisco, California. The team members can be found on every continent. There is also Solana Foundation, a non-profit working on promoting and supporting Solana’s blockchain, based in Switzerland.

What is Solana Coin (SOL)?

Just like ETH, a cryptocurrency SOL, which is a Solananative token, is the lifeblood of the platform. The ledger keeps record of transactions that are denominated in it or in the SOL-based tokens.

Solana coin is inflationary but the rate of issuance is designed to be decreasing. The current rate is 10.5% but in ten years, it is programmed to have about 1.5% annual inflation rate.

According to Messari.io, the current circulating supply of SOL is 342,378,734.11, and the liquid supply is 532,186,728.00.

What is Solana used for?

Low transaction fees and throughput of about 65 thousand transactions per second make it a legitimate alternative to Ethereum.

Another use is to stake Solana. Anyone can validate transactions, but the hardware and bandwidth requirements of running a node are rather high.

In case you cannot afford to run a node, a stake of SOL tokens can be delegated to a validator, of which there are 1,283 at the time of writing.

Comparison with Similar Projects

The first competitor that comes to mind is Ethereum, the problems of which Solana set out to solve. Ethereum has a throughput of about 16 tps and can realistically scale only with second-layer solutions until the merger with Ethereum 2.0.

Binance Smart Chain, the second most popular decentralized finance and smart contracts platform, can handle more load but is often criticized for being a centralized system.

There have been other projects with premises and scaling capabilities similar to Solana. Marlin is an open protocol that provides a high-performance programmable network infrastructure for DeFi and Web 3.0. However, unlike Solana, Marlin runs on top of Ethereum.

What is Solana Criticized For?

Solana is often criticized for being rather unstable. In December 2020, Solana network went offline for approximately six hours. The critical fault could have been solved in a less amount of time, but the decentralized nature of the platform demanded consensus.

In September 2021, bots barraged the initial DEX offering Grape Protocol with denial of service attacks so severely, the entire network went down. The downtime lasted a total of 17 hours.

There were other bugs that could have endangered the network but were discovered in time. A bug that allowed the withdrawal of more fractional tokens that were deposited to a protocol was found by Neodyme and fixed.

As previously mentioned, bandwidth and hardware requirements to validate transactions are rather high: 12 core CPU, 128 GB of RAM and 300 MBit/s connection are recommended. This limits the number of possible validators and stifles decentralization.

Partnerships and Future Plans

The most prominent partners of Solana are established players of the market, Circle and Tether. After all, it is crucial for a DeFi platform to incorporate solutions like stablecoins which found adoption in the sphere.

Another example of Solana adopting decentralized finance staples would be the cooperation with Chainlink for price oracles.

After the mainnet launch, there have been no set roadmaps for the Solana platform. Instead, the devs and community focus on bringing more projects into the ecosystem.

With the explosion of popularity in non-fungible tokens and Play-to-Earn, it was only a matter of time until NFT collections and games would appear on Solana. MonkeyBall and SolChicks gained appraisal from dozens of high-profile investors — though the latter raised some stir with its 113 backing venture capital funds.

Solana itself is still receiving funding from companies interested in the development of its ecosystem. In March 2021, investments from OKEx and MXC totaled to $40 million.

Social Media Posts

I’m paving new avenues for NFT growth through my Collab I got coming wit @Babolex on https://t.co/vaUYWClg2n

🎥👊🏾💥💫 #Solana pic.twitter.com/tdifEjX5T4— Snoop Dogg (@SnoopDogg) December 7, 2021

Snoop Dogg is one of the biggest celebrities endorsing crypto at the moment, and the fact that he collaborated with Solana raised the community interest by a lot.

HOW TO MAKE IT BIG minting Solana NFTs.

An easy, step by step, guide based on my experience of seeing how the best in the space get it done. 🧵 (1/7)

— Benny | 💀🤖🦍| brainless.sol (@Benny_Brainless) December 6, 2021

User Benny documented their experience on the NFT branch of Solana. Make sure to take the advice in the thread with a grain of salt, since it is ironic.

it really be like that.

love you solana pic.twitter.com/FkgA1jBO0t— Currylicious (GANG) 🏀 (@curryliciousSOL) December 7, 2021

Solana users are more clear about their preferences than even the Solana devs, who deny competition with Ethereum. Low fees and high speeds are a strong enough incentive for the Solana community to root for their platform.

Where to store SOL

If you are looking for wallets exclusively for SOL, take a look at Solflare or Sollet. They support Solana-based tokens and some dApps.

However, most crypto users own more than one currency. You can check out software Math Wallet and Trust Wallet or Ledger for cold storage. In the Exodus wallet, you can delegate a stake and exchange SOL right in the app.

How to Exchange SOL?

You can trade Solana on most crypto exchanges but trading on an exchange comes with some hassles. You have to create an account and deposit funds into the exchange’s custody. It takes time and your trust in the platform.

ChangeHero is an alternative way. It’s extremely easy to buy Solana with any currency supported by the service. ChangeHero is a non-custodial instant cryptocurrency exchange, so you won’t have to worry about setting up an account or deposits.

Exchanging Solana with ChangeHero can be done in a few easy steps:

- Choose the currencies on the home page, amounts and the type of exchange. Provide your wallet address in the next step and check the amounts;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send in a single transaction the sum of cryptocurrency you will be exchanging. Fixed Rate transactions have a 15-minute limit;

- All done? Now we are doing all the work: checking the incoming transaction and doing the exchange as soon as it arrives.

- The Best Rate transactions will use the rate current to the time when your funds arrive.

The Fixed Rate will use the rate at the time of step 1;

- The Best Rate transactions will use the rate current to the time when your funds arrive.

- As soon as the exchange has been processed, your SOL tokens are on the way to your wallet.

Our customer support is available round the clock in the chat on the website or through the email: [email protected].

Conclusion

We can say Solana is a successor to Ethereum in DeFi, because it significantly improves the user and developer experience. If it had an ecosystem as diverse and vast as Ethereum, DeFi would be way more mainstream.

If you enjoyed the Solana guide, do check out more guides and digests in our blog! The updates are regularly posted to Twitter, Facebook and Telegram, so don’t forget to subscribe.